Travis Kalanick

What is Travis Kalanick, disgraced former CEO of Uber, up to these days? He’s got a new “stealth” startup called CloudKitchens. Has he learned anything from his past mistakes? Absolutely not:

A list of corporate "values" laid out the guiding principles for CloudKitchens, the stealth startup that Travis Kalanick was now running in the aftermath of his public ejection from the CEO job at Uber. Several members of CloudKitchens' senior team, meeting for a retreat at Southern California's tony Terranea Resort in 2019, recognized their new corporate values with a sense of disbelief.

"Always be hustlin'"

"Big bold bets"

"Super pumped"

"Champion's heart"

Oh boy. Kalanick bought a “ghost kitchen” startup three years ago and turned it into CloudKitchens. He invested a reported $300 million of his Uber fortune and took another $400 million from the Saudis, who have remained one of his allies after Uber.

Kalanick immediately set about recruiting employees from Uber and creating the same toxic work environment:

Inside CloudKitchens, people describe an alpha-male organization helmed by a "temple of bros," in which Kalanick and two pals reign supreme and where a "Fight Club"-like code of secrecy affects all aspects of the job. Visual cues, like "No Quinoa" T-shirts worn by Kalanick loyalists, reinforce a hard-knock culture that frowns on coddled techies.

Since the start of the year, more than 300 corporate employees have left the company, some of whom say they quit over paltry bonuses and a contentious new leveling system.

Unlike at Uber, however, Kalanick no longer has to contend with VC investors on his board of directors - he and the Saudis have total control over CloudKitchens.

So what is CloudKitchens? The company has two arms - real estate, and technology. Essentially, it purchases property in cities, converting it into spaces for virtual restaurants - some are delivery-only, and some offer seating and takeout options. The company promises its tenants an advanced tech platform - called Otter - to streamline delivery and takeout orders and maximize efficiency.

Kalanick had planned a WeWork-style expansion, but has found it harder than expected:

But on its real-estate side, CloudKitchens had some growing pains. Former employees said the problem started with buying bad real estate — sites that came at a bargain because they'd been long vacant or were even subterranean — that couldn't be outfitted with the number of kitchens Berdakin and Diskin expected.

The two execs built a prototype CloudKitchens facility at 1842 Washington Blvd. in Los Angeles, and modeled the company's initial projections after their costs. But scaling a real-estate business is very different and much more expensive than building a prototype with parts from Home Depot. Future build-outs cost five times as much as the prototype, former employees said, and teams felt so pressured to keep costs down that some managers started hiding invoices.

Not a great sign. Since CloudKitchens is renting these spaces, missing launch deadlines meant some of its tenants were stuck paying staff to do nothing:

Some of CloudKitchens' projections for schedules and budgets were written to the best-case scenario, with little wiggle room for when things inevitably went wrong. Pushed move-in dates meant customers sometimes needed to cover weeks of payroll for staff who weren't working.

[…]

Employees said that three years into Kalanick's tenure, they expected CloudKitchens to have hundreds of sites. Because of the startup's opacity, it's hard to track how many locations are operational; Insider counted that 24 out of 46 identified US locations were up and running.

CloudKitchens has signed deals with major brands including Wendy’s, Chick-fil-A, and Burger King. Little is known about the size of the investments, because CloudKitchens is extremely secretive. Kalanick’s paranoia created friction within the orgainzation:

One person likened the culture at CloudKitchens to joining the CIA, where employees can't even tell their families about their jobs.

[…]

The lack of visibility extends inside CloudKitchens. Former employees said they had little insight into their colleagues' activities in other divisions and geographies.

[…]

Berdakin and Diskin kept the property and operations teams in the dark from each other, so one rarely knew what the other was doing. "They don't need to fucking know. They're idiots. Don't worry about it," a former employee recalls Diskin saying about the operations team.

Employees are expected to work long hours and take salaries below industry standard, though recruiters promise equity and bonuses. That, however, was another bait and switch:

Employees said they felt penalized if they asked for a bonus or a raise because it was viewed as a sign they didn't believe in their equity's potential. Some of those who could choose their bonus structure — cash or equity — said they felt pressure from managers to take the equity after Kalanick said at an all-hands that he wanted to invest the cash earmarked for bonuses back into the company.

The equity was back-loaded, requiring an employee to stay a full 4 years to get the bulk of their payout - losing everything if they quit or were fired before the 364th day. As to whether the equity is worth anything, that remains unclear as well:

Most hot startups raise capital regularly, so employees have some idea of their equity's value and receive opportunities to cash out. Because Kalanick hasn't yet raised more outside money, employees have no idea what their equity is worth.

Despite Uber’s disastrous entry into China, Kalanick is expanding there:

He's expanding in China, largely by acquiring smaller companies, in hopes of conquering a market that eluded him at Uber. CloudKitchens' geographic expansion uses the same playbook as Uber: hire general managers — at least 12 of whom came from Uber, by Insider's count — and scale fast.

So Kalanick has spent three years doubling and tripling down on all the bad behavior that got him kicked out of Uber, except this time he’s competing in a far more crowded field - Softbank and others are plowing billions into ghost kitchen competitors, and CloudKitchens has struggled to deal with the challenges of owning and developing real estate. He’s hemorrhaging employees due to a highly toxic work environment, which may get worse as the pandemic lifts and delivery orders decline.

I can’t feel too bad about one of the worst tech CEOs lighting a big pile of Saudi cash on fire again, but - as with all these ventures - it’s worth thinking about what else may end up in the wreckage. Many of his tenants are restaurant entrepreneurs trying to run a business - here’s hoping they aren’t left out in the cold if things go wrong at CloudKitchens.

In other CloudKitchens news, here’s a fun piece about the weird, often offensive branded restaurants in their portfolio.

Etsy

Today, the manufacture and sale of elephant ivory are subject to sweeping national and international prohibitions. But listings for the purchase of ivory netsuke and dozens of other products carved from elephant tusks, from jewelry to antique accessories, are readily available on the publicly traded online marketplace Etsy.

And that's just one of the company's rules that are being openly flouted by rogue sellers on the platform.

An Insider investigation identified roughly 800 listings on Etsy selling banned products, which encompass nearly every one of the site's categories of prohibited items. From dangerous weapons to pornography, from poisonous plants to cat and dog remains, from pseudoscientific miracle cures to T-shirts bearing the Confederate flag, the marketplace is overrun by the products that it says it bans.

Now, 800 listings isn’t as bad as selling stolen artifacts or allowing ISIS to run a marketplace on your platform, but it’s not great. It speaks to the problem all online platforms have - by creating a low barrier to entry for independent sellers to list their goods online, Etsy makes it difficult for its staff to police the listings:

When presented with Insider's findings, Etsy deleted the rule-breaking listings and said the company had been planning to increase its investments in systems to detect such content. But even after the takedowns, it was still easy to find many more rule-breaking listings almost identical to the ones Insider originally flagged.

How can these companies fix this? It’s more complicated than it might seem - they have to balance the need for oversight with the “friction” required to sell things. Make it annoying to sign up as an Etsy seller, and they risk losing customers to another platform with less oversight.

It doesn’t end there for Etsy, as they’ve enabled sellers to advertise their listings as well:

Many of the offending listings pay Etsy for advertising to boost their ranking in internal search results, and the company takes a 3 to 5% cut of every sale — meaning it directly profits from the marketing and sale of ivory, weapons, and other problematic products.

Etsy describes itself as an "unjuried" marketplace, meaning that it doesn't directly handle any of the goods sold on its platform and sellers are responsible for abiding by its rules. The company said in a statement that it was always working to improve its system to prevent inappropriate items from appearing on the site through a combination of automated and manual tools, as well as user reporting.

Again! This is a problem we’ve seen with Facebook, Google, Amazon, and any platform that allows advertisers to push their products on a self-serve platform. Sellers find Esty attractive because they can create an account, set up a shop, and immediately start making sales. They can pay to boost their listings so their illegal ivory figurines or nunchucks or poisonous plants appear at the top of search results. While Etsy may be trying their best to police its platform, the reality is that it’s virtually impossible to catch bad listings when your business model is premised on allowing everyone in. Also, when you depend on algorithms written by humans:

An Etsy spokesperson said the existing systems for detecting ivory had been malfunctioning, that the company fixed the problem after realizing, and that it promptly deleted the listings.

Apple

Apple is notoriously secretive about its product development, which helps create buzz around their announcements throughout the year. Earlier this year, a gang of hackers found an inventive way to attempt to extort the company:

The notorious ransomware gang REvil said they had stolen data and schematics from Apple supplier Quanta Computer about unreleased products, and that they would sell the data to the highest bidder if they didn’t get a $50 million payment. As proof, they released a cache of documents about upcoming, unreleased MacBook Pros. They've since added iMac schematics to the pile.

The hackers hit a hardware vendor farther down in the supply chain, who was likely much easier to penetrate than Apple. In the past, ransomware attacks would seize and encrypt files on company networks, demanding money to return them. Now, the threat of leaking information - or exposing the existence of a breach in the first place, which could lead to privacy fines under new laws like GDPR - may be an easier way for hackers to extract money from large companies.

Privacy protection is one thing - at this point, do any of us maintain the illusion that our data hasn’t be caught up in one breach or another? Stealing and leaking intellectual property is far less worrisome, as far as I’m concerned - the fact that tech firms value their intellectual property in the tens or hundreds of millions’ of dollars speaks to how ridiculous our consumer markets have become, when relatively minor design and feature changes are worth so much in a captive market.

Fake Court Orders

I’ve written about people using fake court orders to get out of criminal charges, but this is a new one:

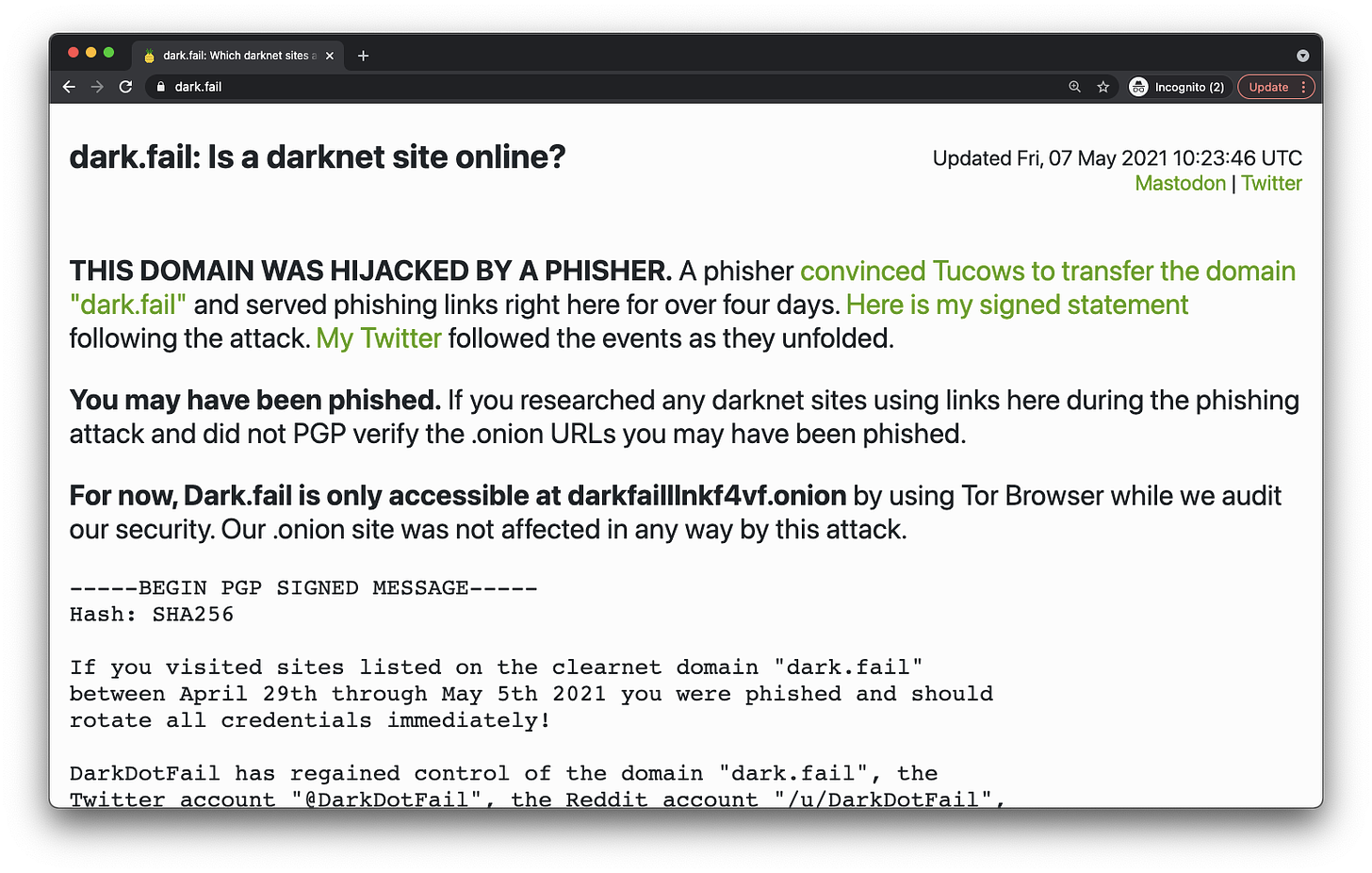

A scammer used a fake court order to convince a domain registrar to transfer ownership of a domain that lists dark web drug markets, and then used that to point the sites to their own copies of the markets designed to steal peoples' bitcoin.

A creative hacker used a fake German court order to get a dark web drug market directory website transferred to another registrar, and imposed a gag order on both registrars so the original owner wasn’t informed. Then they stood up a meticulously crafted version of the website, which snooped on users and stole their crypto account passwords:

After the domain hijack, the attacker replaced each link with a phishing site, according to a message on dark.fail posted after Dark Fail regained control of the domain.

"Each site looked real but instead shared all user activity with the attacker, including passwords and messages. Cryptocurrency addresses displayed on these sites were rewritten to addresses controlled by the phisher, intercepting many people's money," the message reads.

Dark fail, indeed.

Days Off

I wrote last week about a guy who lied about his birthday to dozens of women in a gift scheme. A bank worker in Taiwan had a different scheme to get more time off:

In Taiwan, one of the few places in the world to offer marriage leave to couples heading to the altar, a bank employee wed his partner on April 6, 2020.

They got divorced days later, on April 16.

Then they remarried the following day.

Another divorce and a third marriage followed on April 28 and April 29.

After a third divorce, on May 11, they got married for the fourth time, on May 12.

It was all a plot to take advantage of the self-governing island’s time-off policy for couples who get married — eight days of leave — the man’s employer, a bank in Taipei, said in public records.

I mean, okay sure. This seems like a lot of…work to get a month of PTO. When the bank refused to approve his additional days off, he filed a complaint and won:

That prompted him to lodge a complaint with the Labor Department for violations of leave entitlements. The bank was fined $700 last October, but appealed the penalty in February, claiming that the employee had abused his rights.

After much public debate, the head of the labor department in Taipei City, Chen Hsin-Yu, announced last week that the bank’s fine would be revoked.

Unlike Japan - noted spoilsports, who arrested the Gift Bandit - the government of Taiwan took the opportunity to debate the issue publicly, which I think is lovely:

The case has also thrown the labor authorities in Taipei, the capital, into disarray and raised questions about how easy it is to exploit the marriage leave policy. In a statement, Ms. Chen, the labor official, called on public servants not to lose sight of common sense.

Taiwan has generous worker benefits, and one instance of a worker trying to take advantage of it has sparked a nationwide debate. Imagine living in a country with strong worker protections and civil public discourse!

How is Jacob Wohl Doing?

In a press release, [Tish] James said that an investigation by her office found that the duo reached about 5,500 New Yorkers with their calls and, in doing so, “violated state and federal laws by orchestrating robocalls to threaten and harass Black communities through disinformation, including claims that mail-in voters would have their personal information disseminated to law enforcement, debt collectors, and the government.

The New York Attorney General has found 5,500 residents who got targeted by Wohl’s robocalls, and is seeking to join the federal lawsuit against him. Huh!

If allowed to join the suit, James intends to seek a penalty of up to $500 per violation from the defendants, which could total $2,750,000, and they would be required to forfeit any profits made from the campaign.

It’s important to remember that your illegal political stunts may land you in hot water if your party loses.

Short Cons

NY Times - “To receive the money, Ms. Churchill had to fill out a “membership form” sent by an organization calling itself the MacKenzie Scott Foundation and set up an online account with Investors Bank and Trust Company.”

Deseret News - “The FTC alleges that some Vivint sales representatives were using a process known as “white paging,” which involves finding another consumer with the same or a similar name on the White Pages app and using that consumer’s credit history to qualify the prospective unqualified customer.”

Bloomberg - “Sanjay Shah, a former hedge fund manager charged in two countries over the Cum-Ex scandal, is accused by German prosecutors of using a Jewish school in New York to execute trades totaling 920 million euros ($1.1 billion) as part of a plan to deceive tax authorities.”

NY Times - “The effort generated roughly nine million comments to the agency and letters to Congress backing the rollback, almost all of which were signed by people who had never agreed to the use of their names on such comments, according to the investigation.”

Tips, thoughts, or phone schematics to scammerdarkly@gmail.com