Do you like nice things? Lots of people do! Fancy cars, exotic watches, expensive sneakers, rare art. Coveted, and very difficult to obtain. But, what if you could buy a piece of a great work of art, or a rare car? As an investment? Well, it turns out you can. This week, follow me down the rabbit hole of luxury asset securitization, which all started when I stumbled across an ad.

Getting a Taste

The concept of taking something of value - an asset - and chopping it up into smaller pieces so that people can buy in is not new - in fact, it dates back to the 17th century, and we have the Dutch to thank for it. It’s also how our stock markets run - purchasing shares of a company or investment vehicle - like index funds - gives you a tiny fraction of ownership, which comes with various benefits and risks.

Typically, people want to buy a share - a security - of an asset to make money. They believe the value of the asset will go up over time, and they will get a percentage of that gain. It’s why most people plunk money into a retirement vehicle like a 401(k) and don’t think about it for forty years. Compound interest charts are very attractive when you zoom out far enough.

Anyhow, here’s a story in the New York Times about a different type of securitization:

High-price luxury items like sports cars, fine art and even rare first-edition books are generally beyond the reach of average collectors.

Now, several technology companies are packaging rare cars, paintings, and books as offerings in which any collector can buy shares. Some offerings start with prices as low as $25 or $50 a share. In return, these retail investors can, the pitch goes, participate in the appreciation of a famous painting in the same way billionaire art collectors do.

Note that the author calls them technology companies, which do not seem like the sort of companies I’d want handling investments in highly volatile assets? I do appreciate the warning a paragraph later:

The prospect of buying shares in collectible luxury items, known as passion assets, is certainly appealing. But when the underlying asset is fairly illiquid and not divisible, investors should proceed with caution.

Passion assets? Sure, why not. The problem with taking, say, a rare Porsche and chopping it up into $25 shares is that, as the author notes, you cannot chop the actual car into ten thousand pieces and distribute those to shareholders, should it fail to sell. Buying shares in a passion asset, owned by a technology company, is putting your faith in their ability to sell whatever it is at a profit. But can they? Who are these people?

Masterworks

One of the things that inspired me to write a newsletter was reading other, excellent newsletters. One of these is written by Bloomberg’s Matt Levine, and I cite him in my work sometimes. This week, I came across this ad in the middle of one of his daily dispatches:

I do not know whether Matt Levine decides which ads appear in his newsletter, and I do not want to cast aspersions. It set my senses tingling, however, and I clicked through to the Masterworks website and boy, it sure is something.

Masterworks says it will let you invest in art:

Masterworks typically acquires ‘blue-chip’ artwork from the major auction houses, with acquisitions focused on artwork representative of a top 100 artist’s mature style, that it is able to acquire at an attractive cost relative to value based on estimated historical appreciation rates, and an established track record of multiple multi-million dollar sales annually.

I reached out to the company, and a representative told me that they have “closed” five paintings, meaning they are fully securitized. They have two paintings “live” at the moment - or open for new investment - a Basquiat, and a Monet. When I asked why their website does not list five of the seven paintings, I was told that they are visible to subscribers, or people who join the site as prospective investors.

Their terms go on to explain how they structure the investment deals, with each work of art having its own LLC:

Masterworks creates a Special Purpose Vehicle (Delaware LLC, taxed as a partnership) that contains only the painting — no other material assets, or debt

Seems fairly straightforward. How does the accounting work?

Following a sale of the Painting, payment of all of such taxes and expenses, the Special Purpose Vehicle will be liquidated, and the remaining net proceeds, if there are any, will be distributed to the then holders of record of our shares in accordance with the priorities set forth in our operating agreement.

When paintings are sold, the company distributes any proceeds, if there are any. As with many types of investments, various costs and fees can reduce the value of the asset.

Masterworks issuers are limited liability companies that elect to be taxed as partnerships. Each person that holds Masterworks issuer shares will be sent a Form K-1 following the end of each tax year. We do not anticipate that any Masterworks issuer will generate taxable income during any tax year, other than the tax year in which the artwork is sold and only if the artwork is sold at a profit. Title to the artwork owned by the Masterworks issuer will be vested in a wholly owned Cayman Islands subsidiary of the issuer that is taxed as a corporation.

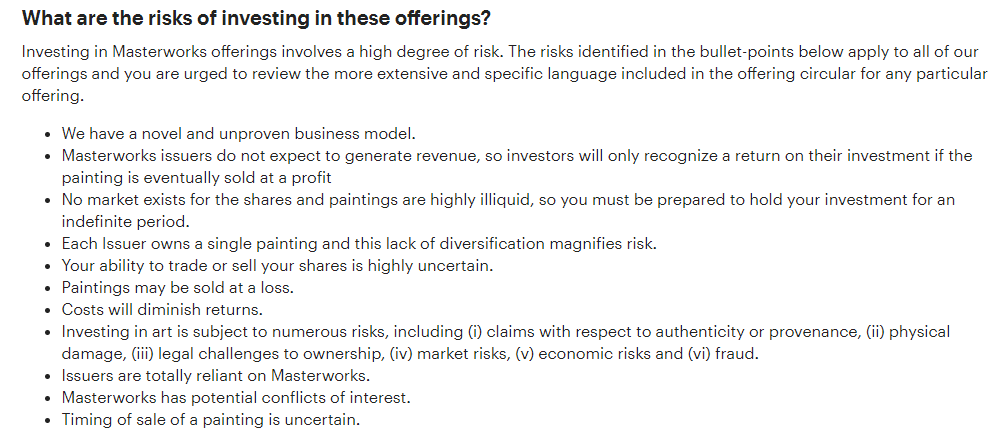

So, investing in Masterworks makes you a partner in an LLC that owns a Cayman Islands subsidiary, that owns the piece of art. The company goes on to include a standard risk disclosure, with a few inclusions that highlight how volatile the passion asset market can be:

Right above this section, Masterworks says - in big, bold green text - that the private art market is worth almost $2 trillion dollars and global sales are $64 billion dollars, with 9% average annual returns. The risk disclosures are in nested menus below.

Originally, it appears that Masterworks attempted to launch as a blockchain art purchasing start-up, but has pivoted to a more standard, SEC-regulated investment structure, though it is unclear when this happened and the person I spoke to did not have knowledge on the subject. In 2018, a few months after Masterworks launched its blockchain version, the SEC decided to start cracking down on blockchain securities. This was the original Masterworks sales pitch, in 2018:

Masterworks today announces its launch as the world's first blockchain-based fine art investment platform that will allow anyone to invest in specific works of art. All offerings will be filed with the Securities and Exchange Commission with share ownership recorded on the Ethereum blockchain to provide transparency to investors.

And their first offering:

For its inaugural offering, Masterworks plans to offer an investment in Andy Warhol's 1 Colored Marilyn (Reversal Series), 1979. Purchased by the company in November 2017 at Phillips' 20th Century & Contemporary Art Evening Sale for $1,815,000, investors will be able to invest in Warhol's iconic 1 Colored Marilyn (Reversal Series) for as little as $1,000 USD.

So, the minimum investment in the Warhol was 50 shares at $20 per share. Early investor interest, according to this article a few months later in the New York Observer, appears to have been modest:

While $20 is the lowest entry point, Lynn claimed that the average investment is in the $2,500 to 5,000 range, although some investors have put in more than $50,000. In its short existence, 1,374 people already have acquired shares in the Warhol, while another 474 have bought into the Monet.

Masterworks founder, Scott Lynn, had ambitious plans out of the gate:

The plan, Lynn stated, is to resell the artworks within 120 days, returning the investors’ money plus any profits, less a two percent administrative fee and 20 percent of the sale gain, which Masterworks retains.

This is a very short timeline in the art world. Later, in the 2019 New York Times piece, Lynn changed his tune:

Mr. Lynn said he tells investors to plan on holding their shares for three to seven years.

Masterworks confirmed to me that no paintings have yet been sold, though prospective buyers can place bids via their website.

One thing that can trip up alternative investment schemes is the inability to trade shares. This prevents investors from exiting their investment if they decide they are no longer interested. You may recall my piece on Aristophil - what brought them down was angry investors filing complaints when they couldn’t exit the fund. Rally, another passion asset investment company, offers a trading platform where investors who buy shares can sell them to one another. Masterworks tells me they have opened their trading platform on a limited basis as of last week. They say they are not a “market maker” and investors will set their own buy and sell prices for the shares in their paintings.

Back in 2018, when the Observer covered Masterworks, Lynn claimed he was keeping the paintings in storage with his own collection. In 2019, Masterworks opened a gallery in New York where they display prints of the paintings, while the real ones are kept in secured storage. The gallery appears to exist primarily as a marketing tool for recruiting more investors, rather than showcasing the art to find a potential buyer. There’s also this year-old picture from the gallery’s Google page:

Here we see the Warhol, still open for investment a year after the company’s launch, though I am told it has now closed. The Monet is listed as “Coming Soon” despite having had nearly 500 investors, according to Lynn, back in 2018. The Masterworks Google My Business page has 11 perfect 5-star reviews, all within 2 months of the gallery opening, and all from people who do not appear to live in New York or have posted any other photos or reviews in the city. The Masterworks Instagram account has over 15,000 followers and regularly posts pictures of artwork with auction information, though it does not claim to own or be involved in any of the sales. No one has checked in at the Masterworks gallery location on Instagram or Facebook since September 2019.

While the public-facing Masterworks website does not list the art, Scott Lynn did an interview on Fox Business in 2019 and talked about some other paintings, including a Banksy “Mona Lisa” which was featured on the show alongside the Monet:

A February Wall Street Journal article on the art market cites two auction purchases by Masterworks - one may be the Basquiat referenced in the Fox Business interview:

“Basquiat is the best ‘risk-adjusted’ return for any artist we track in the blue-chip segment,” says Mr. Lynn. His firm wound up paying Christie’s $5.1 million for the artist’s 1982 work, “The Mosque,” under its $5.2 million low estimate. The firm also paid the house $1.9 million for Ms. Brown’s 1999 “Girl Trouble,” just over its $1.8 million low estimate. Mr. Lynn says Ms. Brown’s works historically appreciate in value 13% year over year. The firm will now put the paintings on its investment platform so its 36,000 subscribing investors can buy $1,000-plus shares in the works. Investors aim to reap profits if the art is later resold for a higher sum.

This is also the first mention of “subscriber” numbers. A Masterworks representative told me the number is higher than 36,000 now, two months later. The link I followed from the Money Stuff newsletter informed me that the "waitlist” to become a subscriber has 1,323 people in it, but that I can skip the waitlist as a Matt Levine Reader. Thanks, Matt!

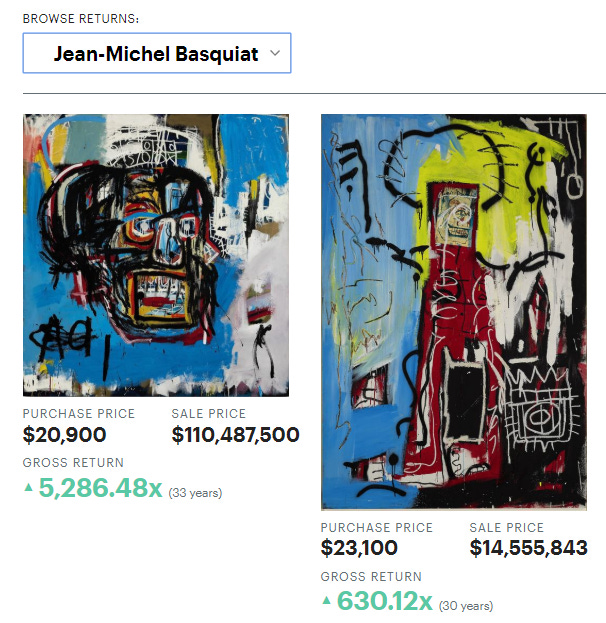

Masterworks may be considered a tech company by the press because they offer market research tools on their website. Their “Insights” page purports to help visitors educate themselves about art markets. Their main marketing website, however, blurs the line between a research tool and a sales pitch. Below is a “search” for Basquiat:

At first glance, these may appear to be paintings Masterworks has acquired and flipped on the market. In reality, they are sales made by other collectors, over a span of decades. Masterworks uses cherry picked eye-popping sale figures, and leaves open the implication that investors in their assets could see similar returns. Buying a Basquiat for $20,900 does seem like a great deal, though you need a time machine to the 1980s to get it done. They also use searches with their research tools as a marketing tactic:

In an interview, Scott Lynn compares his company to a payday lending company:

Scott Lynn, founder and chief executive at Masterworks […] points to Lending Club, a pioneer in this investment model. Along with other peer-to-peer groups, Lending Club makes high-interest, short-term loans to individuals with money from other retail investors.

An article from 2004 in a local Kansas City publication, talks about Scott Lynn’s origins in digital marketing:

His site, Treeloot.com, enticed users to find treasures of up to $25,000 hidden in pixels on a computer-generated tree. With more than 170,000 pixels on the tree, most “winners” settled for coupons from advertisers. (Lynn says Treeloot has given away $1 million in cash and prizes.)

Treeloot became one of the Web’s most popular sweepstakes sites. Twelve million users visited each month. USA Today and The Washington Post sought interviews with the company’s young founder. But not all publicity glowed. To attract visitors, Treeloot dared surfers to “punch” a monkey that scurried across Web pages; doing so took the user to Treeloot.

I admit, somewhat sheepishly, that I was in digital marketing at the same time as Scott Lynn, and am very familiar with his ads, if not the man himself. Virtumundo moved into mostly e-mail marketing, utilizing the popularity of its sweepstakes sites to build large consumer lists and send them offers on behalf of other advertisers. Lynn began working on other projects with his new venture AdKnowledge, which was been re-branded as V2 Ventures. He also founded Payability, which provides “daily working capital” for e-commerce businesses, commonly known as business factoring.

Lynn’s love of art was clear, even back in 2004:

Jim McCarthy, the original contractor on Lynn’s house, knows something about how demanding a boss Lynn can be. The job was hardly routine. Plans called for the installation of a wine cellar, a panic room, an elevator shaft and a subterranean art gallery with koi pond.

It may have taken him 14 years, and he’s traded in his subterranean koi pond for a gallery in SoHo, but Scott Lynn is now gambling on the overheated art world, allowing the general public to take a small stake in what his own company admits are risky and illiquid assets.

I often ask - is art a scam? Some elements of the art market most certainly are. It is rife with fraud and graft, and the people buying the art tend to be some of the worst people out there. But, considering all the other stupid shit people invest in, is betting on rich people continuing to overvalue paintings in order to hide or flaunt their wealth really a bad bet? The Punch-a-Monkey Guy is betting it isn’t.

Buy the Drop

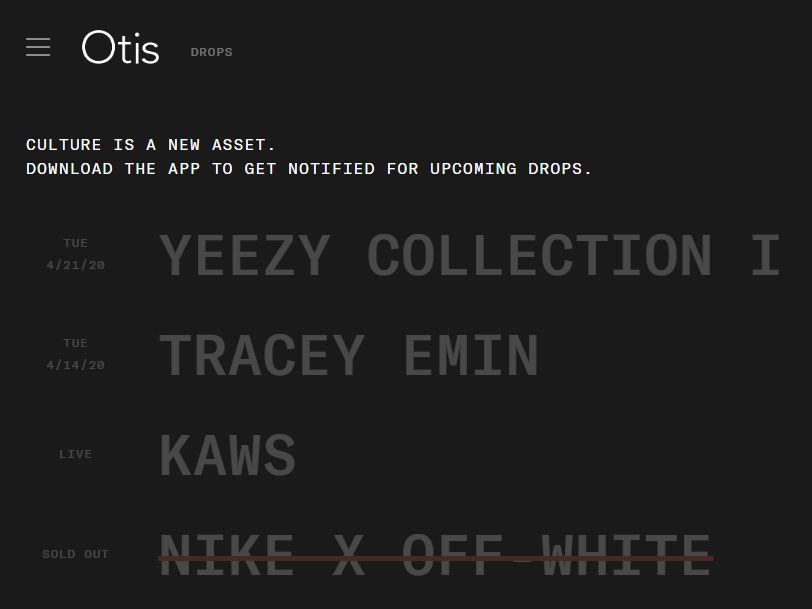

Holy shit, that was exhausting! Doing actual journalism? Who’d have thought! Let’s talk about something more fun. There is a company that exists in an even more perfect confluence of my worlds - questionable investments, and sneakers! Meet Otis:

Yes, you’re reading that correctly. You can buy fractional shares of Yeezys. Otis’s business model is nearly identical to Masterworks - you become an investor in an entity that holds your sneakers or your piece of art or your comic book and if/when it sells, you get a piece.

Otis says they have a “trading” platform coming soon, which may be the way passion asset companies plan on complying with SEC regulations and staving off shareholder lawsuits. If you can sell someone else your shares, rather than simply sitting on a valueless asset for years, perhaps you’ll be less likely to sue!

Otis does say that if the company is able to obtain revenue by renting or showcasing their “drops”, the funds will be distributed pro-rata to shareholders, which seems okay. I do not know what kind of revenue you can generate putting sneakers in a gallery or whatever, but I also do not pretend to understand the hype world at all. They have a showroom in New York - just like Masterworks - where they hosted an exhibition featuring many of their drops back in October. Unlike Masterworks, their Instagram features photos of upcoming and current drops only, and their levels of social media engagement are significantly higher, indicating their 8,000+ person following may be genuine enthusiasts.

In the New York Times piece I cited originally, there is a quote I found interesting, regarding Otis:

The bet on appreciation has some artists and other cultural creators interested. The street artist who goes by Fnnch said he was creating his largest piece of art for the Otis platform.

Fnnch said he intended to retain an interest in his work, which could help him financially.

Otis has an artists page, where they detail the program:

Inspired by Swizz Beatz' suggestion of giving artists a percentage of all secondary sale proceeds, we’re excited to announce the Artist Initiative. Artists can choose to retain 25% of Otis' profits from the resale of their work.

It is not every day I write about companies who draw inspiration from Swizz Beatz, but here we are. I think it is a good thing to offer artists a way to profit off their work while still alive, but I’m not sure how this…helps them? The company says they plan on holding pieces 5 to 10 years, which might be great if you’re an artist who isn’t starving and can wait that long. If Otis does actually help promote and elevate the artist’s status, the asset will appreciate, and they can cash in. If not? I guess they’ll be back where they started? Very glad I am not an artist, and do not depend on this newsletter for income.

Otis also offers people who have valuable assets the chance to sell through the Otis platform, which might be a better option than going through an auction house? I do not own anything valuable enough to clear the “should I call Christie’s, or use this app I downloaded?” bar, so it’s impossible for me to say.

How popular are the drops? I downloaded the Otis app and as of this writing, the 40 inch KAWS painting the company acquired for around $320,000 is 47% “funded” with 256 investors. The Tracey Emin neon lamp, which was purchased from Sotheby’s and dropped a few days ago, is 11% funded. So - not hot enough to sell out immediately, but not…not hot? Many of the company’s lower priced offerings have sold out, according to their website. Whether an investment in The Incredible Hulk #181 is a good long term play, I suppose time will tell.

Tiger King

I’m sorry, but we need to continue to talk about this show, because while it’s sparked a million unpleasant debates around the Internet, it appears there are serious issues with how the show was made. I won’t waste too many words on it, but here is a New York Times piece that examines the drama on the other side of the camera:

Many of the interview subjects featured in “Tiger King” say the story was presented to them as one that would expose the problem of private big cat ownership in this country, following in the tradition of many conservation-themed documentaries. Some in the film even say Eric Goode and Rebecca Chaiklin, the show’s co-directors and co-producers, claimed to be making the big cat version of “Blackfish,” the award-winning 2013 documentary that spurred widespread backlash against SeaWorld.

Yeah, that’s not really the message most people took away from it, I’m pretty sure! I can understand the draw of framing the story the way the filmmakers did - a battle between the forces of Joe Exotic and Carole Baskin. But, in this case, there could be real world consequences for glossing over the abuses going on at big cat parks:

Critics fear that “Tiger King” creates a glamour around tiger ownership, and assigns a folk heroism to the “Joe Exotic” personality that could set back efforts to end the abuse and ownership of big cats.

Let’s not forget - spoilers! - this dude murdered his tigers. For me, the most obvious ethical issue with the show, and the reason a company like Netflix should be policing it’s content a lot more carefully, is this:

Court testimony also revealed that Mr. Goode and Ms. Chaiklin paid Mr. Maldonado-Passage and other sources. Unlike the makers of reality television, who regularly compensate participants, documentary filmmakers traditionally do not pay sources, Mr. Oteyza of “Blackfish” said.

Yeah, this is not a documentary. It’s a highly edited - and slanted - version of reality, and one that may have lots of negative repercussions, outside of the abuse and threats Baskin and others have faced since its airing.

The media grist mill must churn on though, and Netflix has shamelessly released a “follow up” episode with Joel McHale banally interviewing some of the show’s cast via Zoom. Everything sucks.

Quack Update

What the fuck is wrong with this guy?

Short Cons

Bloomberg - “Carnival’s ships have become a floating testament to the viciousness of the new coronavirus and raised questions about corporate negligence and fleet safety.”

Engadget - “Facebook is suing Basant Gajjar (aka LeadCloak) for allegedly selling software that helped bad actors circumvent Facebook’s automated ad review systems and push deceptive ads around COVID-19 and other scams.”

Bleeping Computer - “Scammers behind business email compromise (BEC) attacks have adjusted their tactics to match the current situation given the tens of millions of employees working from home during the COVID-19 outbreak.”

Bank Info Security - “Travelex, a London-based foreign currency exchange that does business in 26 countries, including the U.S., paid a ransomware gang $2.3 million to regain access to its data following an attack on New Year's Eve”

HITC - “The developers of Cooking Mama Cookstar have denied that the Nintendo Switch title is a bitcoin miner.”

Tips, investment opportunities, passion assets to scammerdarkly@gmail.com