Cover Girls

Kylie Jenner, Museum of Ice Cream, Pizza Fraud, Jho Low, Luckin Coffee, and U-Haul Vans

She’s Just Being Kylie

Last year, Kylie Jenner sold 51% of her cosmetics line for $600 million, valuing the business at over a billion dollars. Her face was plastered all over the news - Forbes suggested she would soon become the youngest self-made female billionaire, at age 21.

Prior to the sale, the Jenner family had spent a lot of time and effort trying to convince Forbes that the brand was making a lot of money. To a very…unusual degree:

During meetings at Kris Jenner’s palatial Hidden Hills, California, estate and the family accountant’s office nearby, Forbes was shown tax returns detailing $307 million in 2016 revenues and personal income of more than $110 million for Kylie that year.

[…]

After speaking with a handful of analysts and industry experts who also found the Jenners’ claims implausible, we settled on a more reasonable estimate for our 2017 Celebrity 100 list: $41 million in overall earnings for Kylie, good for the No. 59 spot. Kris was “so frustrated,” the Jenners’ PR flack shot back. “We’ve done so much.”

Unhappy with Forbes’s refusal to play ball, the Jenners went to other publications who would print their claims without any sort of fact checking, and their tale grew:

By the summer of 2018, when Forbes set out to calculate Kylie’s net worth for our list of the richest self-made women, the industry’s opinion of Kylie’s business had shifted. Those huge revenues were “totally possible,” said one analyst, adding that she had heard similar numbers herself. Another suggested revenues were around $350 million. The estimates kept climbing. Revenues were $400 million, according to a Piper Jaffray research note in 2018. An Oppenheimer report projected sales would top $700 million by 2020.

So Kylie got her Forbes magazine cover after all. However, once the sale of half of her brand to cosmetics company Coty happened, the fiction started to unravel:

Then there were Kylie’s financials. Revenues over a 12-month period preceding the deal: $177 million, according to the Coty presentation—far lower than the published estimates at the time. More problematic, Coty said that sales were up 40% from 2018, meaning the business only generated about $125 million that year, nowhere near the $360 million the Jenners had led Forbes to believe. Kylie’s skin care line, which launched in May 2019, did $100 million in revenues in its first month and a half, Kylie’s reps told us. The filings show the line was actually “on track” to finish the year with just $25 million in sales.

Ah, yes. Undone by…public securities filings. It’s apparently a thing rich people do - lying to Forbes to make the list, to achieve status they haven’t earned. The Jenners decided to add their names to that list, in an effort to turn their daughter into the youngest female billionaire. They had accountants forge tax returns and financial statements! For a magazine! Why? I don’t know, I guess her making a mere $340 million dollars selling a cosmetics brand she did actually create from scratch wasn’t impressive enough. Rich people.

Museum of Ice Cream

If you’re like me, and spend too much time Online, you probably heard about the Museum of Ice Cream at some point over the last couple of years - an Instagram-friendly photo space for adults and kids. It includes things like slides into pools of brightly-colored foam sprinkles:

Last year, investors poured $40 million into Figure8, the parent company of the MOIC, and it had plans to expand across the world. Pop-up installations were selling out, and celebrities were fighting to get in. Maryellis Bunn, the 28-year-old founder, was called the “Millennial Walt Disney”.

The truth, according to a Forbes exposé, was quite different:

Spending was slashed in January. In March, Bunn temporarily closed the permanent installations in New York and San Francisco, and laid off around 200 workers.

[…]

Bunn manages by intimidation, verbally accosting employees and publicly berating them for mistakes, while ignoring the expertise of older, more experienced hires. And above all, these employees say, she displays hubris without the talent to back it up.

Hmm, not great. Who is Maryellis Bunn? Turns out she’s a rich kid - her family are the coffee maker people. This allowed her to “self-fund” the company until last year. It also allowed her to pursue her “goals”:

From those early days, Bunn was obsessed with becoming the next Disney (which she named as her only direct competitor in her late 2017 Forbes Under 30 vetting questionnaire). At the outset, she created her own “brand book,” which dictated that everything play off a distinct bubblegum-pink tone (Pantone 1905C). She also idolized Steve Jobs.

Can we pause for a minute and think about how much human misery Steve Jobs idolatry has wrought in Silicon Valley? I swear, I read lines like this in many founder stories, right before the allegations of employee abuse and mismanagement show up. Steve Jobs was - by many accounts - an awful person, and yet startup founders think that’s…something to aspire to? Sure.

There are so many horror stories in this piece. I cannot imagine working for someone like this:

Bunn insisted that everyone at the company choose ice cream nicknames like “Strawberry” and “Caramel” that they were expected to use instead of their real names. (Yes, emails sent to addresses like “moosetrackmix@figure-8.co” would go to an actual person.) Bunn’s self-chosen moniker was “Scream.”

“I would regularly go on walks to just cry. We had one room that was the ‘crying room’... or we would go into the utility closet if that was taken,” says a former designer in headquarters, referring to interactions with Bunn. Bemoans another ex-employee: “Even though she's half my age, Maryellis scared the f—k out of me.”

Before the layoffs, Bunn called her weekly company town hall “Scream Sesh,” and they lived up to the name.

Despite all the hype and the media adulation, Bunn and her team don’t appear to have been particularly good at business, which is a problem when you are running a high-overhead venture that requires lots of expensive office space in major cities:

Even before the pandemic and despite the millions raised in August, Bunn’s company was showing signs of financial strain. She’d gone over-budget on Soho (the company claims they simply “changed the initial plan”) and with San Francisco upgrades (including building a bar that ultimately failed to get a liquor license), while planning expansions to Las Vegas, and into Asia.

She also got bored with doing the thing a CEO is supposed to do, and dabbled in other vague-sounding projects:

And she poured time in resources into another experiential project called Hiatus, which in a brand book obtained by Forbes promised visitors would “traverse time’s waves, encountering a surreal mix of futuristic and nostalgic environments.”

This follows a typical playbook - a rich kid uses her money and connections to launch a cool start-up to much fanfare, but has little interest or desire to run it like a business. Bunn and her much-older boyfriend - sound familiar? - started a company with inherited wealth, then tapped their networks of wealthy friends to secure tens of millions’ of dollars worth of investor money. When the music stops, like it often does with these sham ideas, Bunn floats on to her next endeavor, oblivious to the damage she’s done to the lives of her employees.

Pizza Fraud

Speaking of sham ideas, there are few headlines more likely to get me to click on them than The ‘Fyre Festival of Pizza’. Bloomberg Businessweek really gets me. Anyhow, the story is mostly about the man behind a pizza festival in New York City, that didn’t really happen:

Ticket holder Timothy Seitz arrived at the venue with his wife and found a mostly empty lot where hundreds of hipsters were SMH-ing in a line along a barbed-wire fence, waiting to grab a slice. As state investigators would later allege, Osekre had obtained only eight pies and a few boxes of sliders.

I know Brooklyn food can be out there sometimes, but this is ridiculous! Ishmael Osekre, the man behind the festival, is another example of the perpetual hustler - frenetic, bombastic, shameless, utterly disorganized. Characters like Osekre are able to keep their schemes going for years because, generally, people like them and want to believe what they’re being told. It’s a human weakness, and persuasive con men take advantage of it all the time.

Except, I feel like it wasn’t entirely a con. If it was, he may have been a victim of it himself. Osekre, in his correspondence with the piece’s author, does seems self-aware, though of course his stories never quite match up with those of others:

He shared a list of names of past friends and colleagues, but many either spoke critically of Osekre or wanted nothing to do with him. (In the end, I interviewed 45 of Osekre’s associates.)

Imagine the sheer…gall of handing over a list of 45 people you know, and most of them trash you to a reporter! Osekre left behind a long string of events that never quite happened the way they were supposed to - when they weren’t cancelled entirely. He racked up debts he never paid, he left his business partners holding the bag for unpaid bills, he ripped off vendors and contractors and venue spaces. What gets me is - he seemed to be a talented promoter. Hundreds and sometimes thousands of people paid him money to attend his events. Wouldn’t it just have been easier to…put them on? Or to get a job in event planning? I don’t know.

Osekre is now facing multiple criminal investigations, and a string of lawsuits attempting to recover monies owed. With a pandemic, he’s likely out of the event planning game for awhile. Here’s hoping he can turn his persuasive powers to a more…legal pursuit during quarantine.

Jho Low

International thief and fraudster Jho Low remains on the run - probably somewhere in China. As more time passes - and his legal cases around the world proceed in his absence - more financial crimes are uncovered. The latest, in the WSJ, involves the Kuwaiti royal family and Chinese construction projects:

Last September, fugitive Malaysian financier Jho Low traveled to Kuwait, slipping free of international arrest notices and authorities in the U.S. and Malaysia seeking him for his alleged role in a multibillion-dollar fraud.

[…]

The Kuwaiti ties brought Mr. Low new protectors, new business deals and new channels for moving money. Banks there handled hundreds of millions of dollars tied to Mr. Low’s activities, including millions in payments to companies in the U.S. and U.K. to cover his mounting legal bills…

Low has spent the last few years dodging authorities and paying hush money to people he stole from who still have the ability to cause problems. The web of his fraud is so complex that despite reading an entire book about it I can hardly keep it straight. Frankly, keeping track of it all sounds exhausting. I don’t know how he does it.

In this case, Low worked with a Kuwaiti businessman to funnel Chinese investment money to some Kuwaiti royals, in exchange for protection and a conduit for him to launder the cash he stole from 1MDB, the Malaysian investment fund. It culminated in the businessman having to flee the country:

Mr. Kiwan later fled Kuwait, hiding in a truck that took him to Iraq, after he was detained and, he said, beaten and otherwise mistreated by Kuwaiti secret services.

Middle Eastern royals, laundered millions, yachts, Monet paintings, torture, and Chinese government bribes. This guy really does it all!

Luckin Coffee

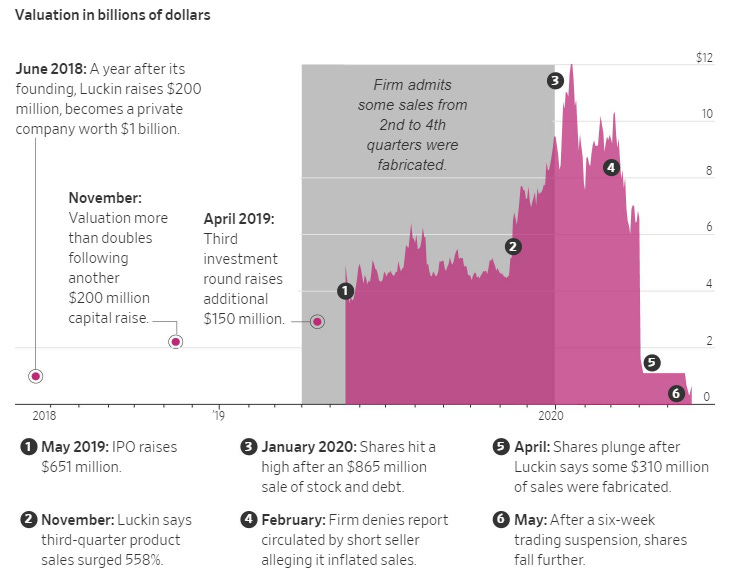

Back in May, I wrote about Luckin Coffee, which at the time had just been exposed for fabricating revenues. One of the problems with being a blogger and not an investigative reporter, is that sometimes I write about frauds that have not yet been fully exposed, so I say things like:

EY China caught the fraud while doing their audit of Luckin’s 2019 financials. The whole thing has a bit of a “take our word for it” feel to me, which is not what I thought publicly listed stocks were supposed to feel like.

However, it turns out that the actual story is far more interesting:

It turns out that Luckin sold vouchers redeemable for tens of millions of cups of coffee to companies that had ties to Luckin’s chairman and controlling shareholder, Charles Lu, according to internal documents and public records reviewed by The Wall Street Journal. Their purchases helped the company book sharply higher revenue than its coffee shops produced.

Meanwhile, other internal documents showed a procurement employee called Lynn Liang processing more than $140 million of payments for raw materials such as juice, delivery and human-resources services. Ms. Liang was fictitious, according to people familiar with Luckin’s business.

Also, it wasn’t caught by an EY audit, but our friends at Muddy Waters, who - in a delightful little scheme - set up video cameras at Luckin locations to prove their sales numbers were massively inflated:

Then, on Jan. 31, Muddy Waters LLC, a U.S. short seller with a record of exposing misbehavior at Chinese companies, circulated an 89-page unattributed report on Luckin. The report said an examination of more than 11,000 hours of video footage of customer comings and goings, of more than 25,000 customer receipts and of observation by 1,500 individuals who visited Luckin outlets showed that much of the company’s revenue must be fabricated.

I love this! I would unironically love to sit around a table at my job and dream up ways to catch shady companies doing frauds. What Luckin was doing, apparently, was moving a small amount of actual money in and out of its bank accounts, while issuing millions of vouchers for cups of coffee and paying distributors and suppliers who did not exist for the ingredients to make its phantom coffee. They did succeed is raising a lot of money off the NASDAQ, because - as I said in my first piece - oversight of foreign stocks on the US markets is essentially nonexistent. As a matter of fact, the exchange even relisted the stock, for reasons?

Nasdaq, although seeking to delist Luckin, last week permitted its American depositary shares to resume trading after a six-week suspension.

Luckin’s fall has rekindled long-running tensions over the U.S. Securities and Exchange Commission’s inability to inspect financial records of Chinese firms to protect American investors.

Uh, yeah, allowing people to try to dump their shares in a company that has mostly fictitious sales and is under multiple criminal investigations does not seem like responsible oversight. Great job everybody.

Do Not Document Your Crimes

There is so much happening here. I love it. Who…thinks to do this? The entire composition of this post is perfect, even the sly emoji at the end. Anyhow, standard disclaimer about doing crimes applies, but if you were to steal an engine out of a U-Haul rental van, definitely do not post about it on Facebook

Small Cons

The Verge - “According to Amazon, the new Counterfeit Crimes Unit will make it easier for the company to file civil lawsuits, aid brands in their own investigations, and work with law enforcement officials in fighting counterfeiters.”

Europol - “The investigation discovered that low quality wines were refilled in bottles under original labels and then sold as real ones on a big online auction platform. The wines were sold in Belgium, France, Germany, Italy, Spain and the United States, often ending in the glasses of unaware customers of wine bars and catering services.”

NY Times - “The cards — featuring a red, white and blue eagle logo and approximately the size of a business card — say the bearer is exempt from ordinances requiring them to wear masks in public.”

South China Morning Post - “Tencent is now taking the embarrassing episode in stride, making fun of itself on social media after being tricked by a group of fraudsters posing as the maker of China’s beloved chilli sauce, Lao Gan Ma.”

Tips, comments, vans with undersized engines to scammerdarkly@gmail.com