Sunday, Fun day?

Skincare brand Sunday Riley has settled with the FTC over allegations they faked Sephora reviews for years to boost sales. Even the CEO - Sunday Riley herself - was in on it!

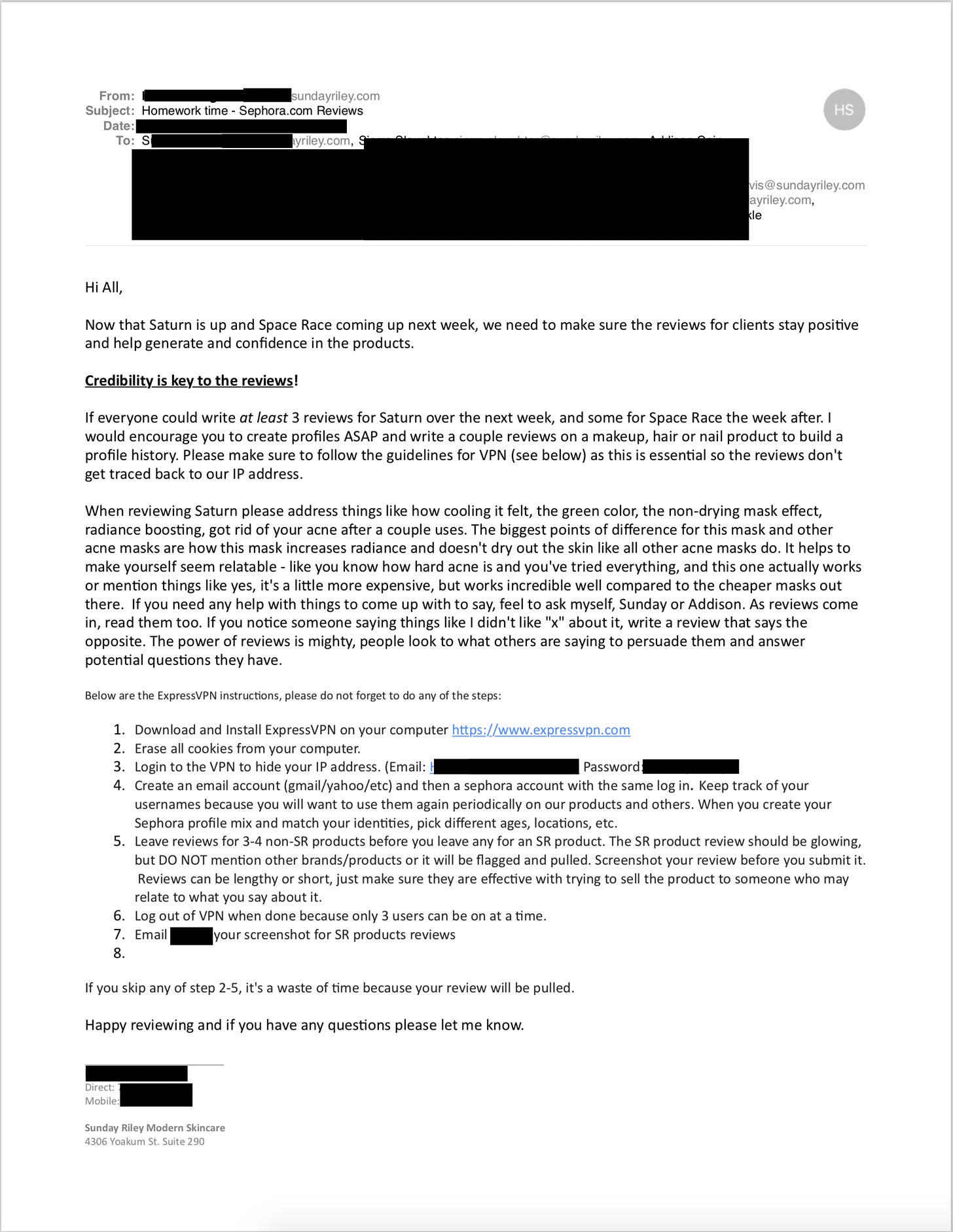

The complaint alleges that in a July 2016 email, Riley instructed her staff to each create three different accounts on Sephora’s website using different identities and to use VPNs to mask their identities.

There are an almost infinite number of stories about companies paying for fake reviews across the web or using services to juice their online ratings, but when your CEO is explaining to you how a VPN works, you may be outside the realm of plausible deniability. One of her employees thought so, and posted on Reddit about it. They included the e-mail they received which is, to say the least, quite damning.

Happy reviewing! Apparently fake reviews are actually illegal which does make sense, since it’s a fraudulent marketing practice. It is impressive how far the company was willing to go - putting their potential criminal behavior in company emails - to juice the sales for their new products. How much is a Sephora review worth?

Are the products any good? Sunday Riley has claimed she has a background in chemistry, though that seems a bit murky. We’ve certainly never seen a charismatic young female entrepreneur make lofty claims about the science behind her products before, have we?

As with many of these settlements, the company has admitted no guilt, and says it will behave in the future. They won’t pay any penalties, either. Certainly a stern warning to any other companies looking to exploit fake reviews to build a brand!

Tulip Mania

When visiting Amsterdam, some tourists buy tulip bulbs. There are markets in Amsterdam where you can buy said bulbs, and - I had to look this up - you can bring them home with you under certain circumstances. However, like all good(?) things, there are people out there who try to ruin it.

Tourists visiting the Netherlands are being duped by vendors selling bad tulip bulbs at famous flower markets, according to a flower growers' association in Amsterdam.

"Tulips are just part of Dutch culture and Dutch heritage," [said] Andre Hoogendijk, deputy director of the Royal General Bulb Growers' Association […]

"We believe that a tourist who visits Holland, or wants to buy something typically Dutch, that they should get a good quality product. And it really hurts … our national patriotic feelings that they buy bad tulip bulbs."

Fortunately these same markets sell other plant-based products you can purchase to treat your injured national patriotic feelings. How bad is this fraud? 98 to 99 percent bad!

Through a commissioned study, the association bought 1,364 tulip bulbs at Amsterdam's famous floating flower market, and after planting them, only 14 — or one per cent — flowered. None looked as pictured on their package.

They also conducted an investigation at another famous market in Lisse, where they purchased 426 bulbs. Only nine flowers — or two per cent — bloomed, and only one looked as advertised.

Apparently the primary distributor of these bulbs to the market vendors in Amsterdam has been using old bulbs that will not flower and selling them to unsuspecting tourists for as long as two decades and no one has said investigated it until now. I’m not sure who tourists would even complain to? I’ve managed to kill a cactus I received as a gift, so I’d undoubtedly chalk up my bulb failure to user error. The article fails to mention whether any action is being taken - or can even be taken, legally - against the distributor. It certainly wouldn’t be the first time the Dutch have duped the rest of the world with tulips.

Golden WeParachute

I wish I could promise you that the latest news out of We is the last you’ll ever have to hear about the company and its founder, but I doubt it.

Former WeWork CEO Adam Neumann will get about $1.7 billion to walk away from the company and give up his voting rights, The Wall Street Journal said Tuesday morning. SoftBank will pay Neumann $1 billion for his shares, a $185 million consulting fee and will offer him $500 million in credit to help repay his loans to JPMorgan, according to the report.

The long story short is Softbank, who has already invested around $11 billion in WeWork, is now going to chase that with another 4 or 5 billion to keep the company afloat.

The $185 million “consulting fee” is certainly something. What exactly did this guy do at WeWork other than run the company into the ground? It apparently also has a non-compete attached, which is good! You wouldn’t want him starting up a WeWork rival and running that into the ground! I will grudgingly concede that he’s handled the situation brilliantly - by keeping his controlling interest in the company, he was able to extract a large, let’s call it maybe blackmail payment from SoftBank, who is attempting to rescue itself from its bad investment in Neumann. There’s probably a clever joke about hostage-taking and threatening to shoot yourself in the head, but honestly I’m just tired.

In case you’re wondering what is going to happen to the thousands of employees at WeWork who do not have three comma leverage, here is a story from just the other day about WeWork, and, well:

WeWork also is planning to cut thousands of employees, but delayed the layoffs earlier this month because it couldn’t afford the severance costs, people familiar with the matter have said.

They didn’t have enough money to pay severance for their employees but they were able to root around in the cushions and find almost two billion dollars to buy (arguably worthless?) stock from the guy who was directly responsible for them all being fired. Dark.

Remember those loans Neumann took to buy luxury properties all over the country? He’s getting help paying those off. You know the old saying; when you owe the banks five hundred million dollars, that’s the Softbank’s problem.

Short Cons

CNBC - “One of his responsibilities at Apple was making sure that Apple employees didn’t do any insider trading. “Levoff’s responsibilities included ensuring compliance with Company-1′s Insider Trading Policy,” according to the indictment.”

American Banker - “Biviano alleges he was deceived into enrolling in TransUnion's $20-per-month credit monitoring plan. He is among over 100 consumers who recently have complained to the Consumer Financial Protection Bureau about being unwittingly enrolled in services offered by one of the three credit bureaus that they say they never wanted.”

Bloomberg - ““We were both married at the time and it was difficult to see each other unless we were traveling,” Pearse said. “I wanted that relationship to continue. I wanted to leave Credit Suisse. I wanted to establish a deeper relationship with Ms. Subeva.””

As always, send tips, stories, or love notes to scammerdarkly@gmail.com.