Pump the Volume

Vaccine Stocks, Kodak, Houston Astros, Fake Death Certificate, and Unemployment Fraud

Trading on the Vaccine

Despite the economy being in the toilet and most people in America being too afraid to do much to help it, the stock market has enjoyed a record-breaking run of gains. Why? Probably because it has now fully become a graph of rich people’s feelings, and not a reflection of reality.

Vaccine manufacturers have been riding the stock market up. They’re in the news constantly - which makes sense, since there are 27 vaccines currently in human trials and showing promise. Most of these companies are publicly traded, which means their stock prices immediately shoot up on any announcement of good news. One such company was Moderna, which made waves for its promising trial results:

After seeking the executive stock plan change in May, Bancel sold more than 72,000 Moderna shares in the first 16 days of July, generating nearly $4.8 million for the executive. That was more than triple the 22,000 shares he had previously scheduled to sell during the same period through the company's executive trading plan.

Another top Moderna executive, President Stephen Hoge, also had his pre-programmed executive trading plan reset around the same time. The change allowed him to sell $1.9 million worth of Moderna stock in the first two weeks of July. Hoge hadn't had any previously planned sale of shares for that time period, company filings show.

This is not a great look, but on the other hand I can’t get too mad about it, with everything else that’s going on in the world. If you are an executive at a vaccine company and you realize your vaccine for COVID-19 might actually work, you have done a good job at being a vaccine executive and may deserve some compensation for that? I guess? My personal belief is that for-profit companies should not be in charge of whether millions of Americans get sick and die in a pandemic, but I cannot afford to be pious at the moment. We need a vaccine.

Anyhow, the “insiders at biotech companies award themselves lots of stock right before a big coronavirus vaccine announcement” strategy is playing out elsewhere:

On June 26, a small South San Francisco company called Vaxart made a surprise announcement: A coronavirus vaccine it was working on had been selected by the U.S. government to be part of Operation Warp Speed, the flagship federal initiative to quickly develop drugs to combat Covid-19.

Vaxart’s shares soared. Company insiders, who weeks earlier had received stock options worth a few million dollars, saw the value of those awards increase sixfold. And a hedge fund that partly controlled the company walked away with more than $200 million in instant profits.

Except, it’s not always that simple:

Some officials at the Department of Health and Human Services have grown concerned about whether companies including Vaxart are trying to inflate their stock prices by exaggerating their roles in Warp Speed

[…]

Shares of Regeneron, a biotech company in Tarrytown, N.Y., have climbed nearly 80 percent since early February, when it announced a collaboration with the Department of Health and Human Services to develop a Covid-19 treatment. Since then, the company’s top executives and board members have sold nearly $700 million in stock.

[…]

Executives and board members at Luminex, Quidel and Emergent BioSolutions have sold shares worth a combined $85 million after announcing they were working on vaccines, treatments or testing solutions.

At other companies, executives and board members received large grants of stock options shortly before the companies announced good news that lifted the value of those options.

There are a lot of these stories in the NY Times article. The playbook appears to be - announce you are working with the government in some form on a vaccine/cure/treatment for COVID-19, sell off a lot of your stock as investors rush in, then, profit?

Pharma and biotech firms are using press releases to pump and dump their stocks, and they will probably get away with it - the SEC is overwhelmed right now dealing with other frauds, and white collar criminal enforcement under Trump has been a joke. The question of whether we will have an effective vaccine soon is an important one, and may result in worldwide conflict. These executives should be using their newfound riches to buy fortified compounds. The vaccine riots may be coming sooner than they think.

Kodak??

Remember Kodak? The photography behemoth spent its first 130 years making film and cameras. Then, due to a combination of mismanagement and changing market forces, Kodak went bankrupt. Then, it emerged from bankruptcy in 2018 and tried to make a bizarre pivot to cryptocurrency - except it sort of…wasn’t really cryptocurrency? It was just a licensing deal? Their stock went up a bunch, and then everyone realized it wasn’t crypto, and forgot about Kodak for two years.

Well, Kodak is back! Seemingly out of nowhere, this happened:

Eastman Kodak Co. shares more than tripled Tuesday on a $765 million government loan to help produce ingredients used in key generic medicines to fight the coronavirus.

[…]

Now, the 132-year-old company will be reorienting part of its factory structure to produce drug ingredients, including at sites in Rochester, New York, and St. Paul, Minnesota, under a new Kodak Pharmaceuticals arm.

[…]

Kodak is now expected to produce several drug ingredients, including those used in hydroxychloroquine.

Huh? Okay, sure. Kodak’s stock went up 1,500% - that is one thousand five hundred percent, yes - and a whole bunch of people made a lot of money. Great, you might be saying to yourself, more insider trading! These damn executives! Believe it or not, there’s an even dumber story behind the sudden jump in the company’s value:

Just after noon on Monday, two news reporters in Rochester tweeted information about a Kodak initiative with the government in response to the coronavirus pandemic.

[…]

The news stories were initially published on Monday after Kodak sent an advisory to media outlets about the initiative, according to Chuck Samuels, general manager of the ABC affiliate. The advisory didn’t indicate that the information wasn’t supposed to be released publicly, he said.

Kodak had issued a press release to reporters that was supposed to be embargoed until the next day, so the president could announce the deal. Except they forgot to write EMBARGO on the press release, so local news in Rochester published it, and a lot of day traders - and others, one presumes - saw it before it was deleted, and started buying Kodak stock, which shot up and looked like a lot of suspicious activity. Great job, everybody.

I mean, there was probably also some insider trading, but with all the other vaccine-related stuff going on, maybe no one will notice. The stock made a whole lot of people on the Internet a whole lot of money, so okay, fine. Really, the problem with this deal is that Kodak is not a pharmaceutical company. The $765 million could have gone to any number of other companies who actually make drugs and could easily scale up operations. Instead, Kodak is going to spend time retrofitting and retooling factories to do something it’s not good at, because for nearly a century and a half they made film and cameras. None of this should surprise anyone - Operation Warp Speed and all the other government programs America has trotted out to combat the pandemic have been completely incompetent. I assume we’ll learn in the coming weeks that a 22-year-old McKinsey intern was the one who sourced and signed off on the deal. Anything is possible.

Asstros

The Houston Astros were involved in a years-long cheating scandal that was exposed last year. Minor punishments against some of the people involved were handed down, and they were allowed to keep their World Series title. They’re also facing a lawsuit from season ticket holders which says they were misled by the Astros’s success into purchasing tickets. I do not feel particularly bad for baseball season ticket holders, but I respect them filing a class action over it. The Astros have adopted a defense which seems a bit…weak:

The Houston Astros are claiming a First Amendment-style law that exists in Texas protects them in a lawsuit that has been filed by team season-ticket holders who are upset due to the club’s sign-stealing scandal, according to The Athletic.

[…]

In court, the Astros are invoking the law by claiming that, since the organization issued press releases which were then used in news stories, ticket holders have no right to sue them based on the content of those releases.

The Astros issued press releases saying they were not cheating, and those were used against them when they were caught cheating, so they are shielded under a Texas First Amendment law? That’s your core defense? Good luck with that.

I hope the Astros lose and have to pay a ton of money, suffer years of public humiliation, and get thrown at by pitchers all over the league. They suck, the organization should have been burnt to the ground, and their fans do deserve refunds.

Get Better at Photoshop

It’s no secret I enjoy writing about people who try to cover up their crimes in amusing ways. With that in mind:

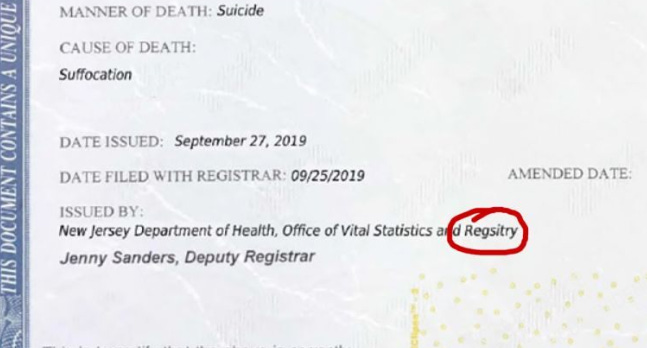

A Long Island criminal defendant tried faking his death to avoid sentencing, but the phony death certificate his lawyer submitted had a glaring spelling error that made it a dead giveaway for a fraud, prosecutors said Tuesday.

[…]

At first glance, Berger's purported death certificate looked like an official document issued by the New Jersey Department of Health, Vital Statistics and Registry, but there was one big problem: Registry was spelled "Regsitry," prosecutors said. There were also inconsistencies in the font type and size that raised suspicions, they said.

Come on, man! Making matters worse, the guy had been arrested in Philly while trying to fake his death in New York:

Berger was alive, but not entirely well. While supposedly dead, he'd been arrested in suburban Philadelphia on charges including allegations he provided a false identity to law enforcement and stole from a Catholic college.

Some people just need a time out. Hopefully he can take some design classes while locked up, and emerge better prepared to forge critical documents.

Unemployment Fraud

States have taken a lot of the brunt of the pandemic, since they depend far more on taxes than the federal government. They’re also responsible for paying out unemployment benefits, which has been a total disaster as claims overwhelm understaffed state offices. On top of all that, the volume of fraud in the system is simply staggering:

An estimated $26 billion will be lost to improper spending of Coronavirus Aid, Relief and Economic Security Act unemployment benefits, a new study shows.

The entire U.S. unemployment system, by contrast, paid out slightly more than $26 billion in 2019, according to research, which cites estimates from the Department of Labor's Inspector General, from The Foundation for Government Accountability, a public policy think tank based in Naples, Florida.

"This is a program that's only existed for a few months, and the amount of potential fraud and waste is 10 times what the entire 50-state system sees [annually], so the $26 billion is ... about the same as what the entire nation generally spends on unemployment for an entire year," Joe Horvath, an accountability foundation policy fellow, told FOX Business.

That is insane. The federal government has pumped trillions of dollars into the economy, including the $600 per week “super unemployment” benefits the states were responsible for distributing. Not all of the $26 billion is fraud, but the fragility of the state unemployment systems has made it much easier to perpetrate:

"Unfortunately, it was kind of a perfect storm for fraud [in which] states had a huge backlog, they've never done something like this before, there weren't proper safeguards in place, and the money was such that there was a huge incentive to perpetrate fraud," [Horvath] said.

I am sure it’ll be fine, with the GOP Senate currently refusing to expand or extend the benefits, or give states the money they’re going to need:

States, as a result of overwhelming benefit requests and fraud, are facing an average 20 percent reduction in their general revenues, and the national debt is expected to rise to $3.7 trillion this fiscal year, the FGA study found.

Unlike the federal government, states can’t simply print more money. Many states and cities have already made significant job and service cuts. Expect to see a lot more of that as a recalcitrant federal government refuses to help out. Sorry, unemployed people, America doesn’t really give a shit about you at the moment.

Short Cons

NBC News - “Federal prosecutors accused a Florida man Monday of fraudulently obtaining nearly $4 million from the Paycheck Protection Program and using some of the money to buy a Lamborghini”

ABC News - “More than 50% of the nation’s counterfeit COVID-19 goods found since “Operation Stolen Promise” was launched 100 days ago came from China, according to Homeland Security Investigations”

LiveMint - “A May 2020 Google Threat Analysis Group (TAG) report highlighted an interesting emerging trend: that these “hack for hire" operations are now increasingly being mounted under the aegis of formally registered firms. “Many are based in India," the report said.”

Tips, thoughts, or hacking for hire to scammerdarkly@gmail.com