Sacklers of Cash

The Sackler crime family, creators of the drug Oxycontin, and currently under investigation for illegally marketing their product and diverting billions of dollars into a shadowy web of offshore entities, apparently took down quite a haul.

…the states cite deposition testimony stating that the Sackler family took $12 billion to $13 billion in cash out of Purdue Pharma

They had been trying to settle the over two thousand lawsuits against them by ponying up $3 billion of their personal cash, selling off the assets of Purdue for another $8 billion or so, and giving their new drugs to the public for free. Turns out they’re still sitting on another potential ten billion dollars that they’ve diverted to their personal accounts.

Where’s the scam? The LA Times did an incredibly detailed investigation into Purdue in 2016 which shed light on the extent of the damage the Sacklers have done. Oxycontin was so profitable because Purdue was able to claim it was effective for up to 12 hours of pain relief based on highly suspect study data, when in reality it typically only provided 3 to 4 hours of relief.

Even before OxyContin went on the market, clinical trials showed many patients weren’t getting 12 hours of relief. Since the drug’s debut in 1996, the company has been confronted with additional evidence, including complaints from doctors, reports from its own sales reps and independent research.

They knew this, and encouraged doctors to over-prescribe their pills, which led to rampant opioid addiction.

More than half of long-term OxyContin users are on doses that public health officials consider dangerously high, according to an analysis of nationwide prescription data conducted for The Times.

Oh, did I mention that they spread the false claim that their product was less addictive than other painkillers? Pretty cool.

The U.S. Justice Dept. launched a criminal investigation, and in 2007 the company and three top executives pleaded guilty to fraud for downplaying OxyContin’s risk of addiction. Purdue and the executives were ordered to pay $635 million. The case centered on elements of Purdue’s marketing campaign that suggested to doctors that OxyContin was less addictive than other painkillers.

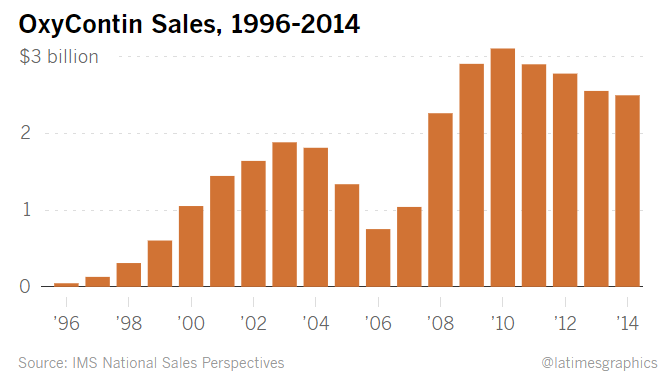

None of this harmed sales, because at this point the ball was rolling:

The Sackler family have been personally implicated in this across many legal disclosures. After all the harm and human misery they’ve caused, they may skate on jail time, and only be forced to cough up a quarter of the money they siphoned out of their company.

Coming Holmes to Roost

Our friend Elizabeth Holmes, disgraced former CEO (awaiting trial for fraud!) and wife to a wealthy hotel heir, apparently can’t pay her legal bills.

“Further, given Ms. Holmes’s current financial situation, Cooley has no expectation that Ms. Holmes will ever pay it for its services as her counsel,” Stephen Neal, John Dwyer and Jeffrey Lombard wrote in the filing

As I say often, when you are rich or rich-adjacent, the rules are different. Can you imagine hiring expensive lawyers for your criminal case, receiving years’ worth of legal work, and stiffing them on the bill with no consequences? I am not a lawyer, and this is not legal advice, nor am I an expert in preparing a criminal defense, but I feel comfortable saying that if you do find yourself facing charges, your lawyers should be the last people you screw over.

Can’t Run a Jet on Options

Remember Adam Neumann? It’s been a busy couple of months for the now former CEO of We(Work). He tried to IPO his cash incineration start-up, was rebuffed by Wall Street, then he and his friends were fired by their investors. As many have observed, however, he made off with a lot of money and still owns a third of the company’s stock. Normally this would be good news, but Neumann’s bankers don’t seem to think so.

Banks that provided a $500 million credit line to WeWork Chief Executive Officer Adam Neumann are looking to revise the terms as his company’s struggle to go public casts doubt on the value of his collateral.

In simpler terms, banks gave Neumann a $500 million dollar line of credit, based in large part on the value of his WeWork stock. Why did a guy who’s sold $700 million dollars worth of shares need another half a bil? Who knows, but it’s notable that he’s taken out $380 million of that line so far. Since the value of WeWork has suddenly become an open question, the banks are understandably nervous, and are trying to re-negotiate the terms. They could make a “margin call” on his shares if the value of the company drops below certain levels, but if the company never sells or goes public, what is that really worth? They could lose some or all of the money they’ve loaned Neumann. I suspect that at some future date we’ll find out what Neumann spent the money on, and I am certain it will make us all very upset.

I bring this up, in part, because another regular feature of the newsletter has some extremely large personal lines of credit from banks. That’s right, it’s the scourge of Pedo Guys everywhere, Elon Musk.

The billionaire’s personal credit lines from affiliates of Morgan Stanley, Goldman Sachs and Bank of America totaled $507 million as of April 30. […]

While Musk, 47, has a $21 billion personal fortune that ranks him No. 43 on the Bloomberg Billionaires Index, he’s relatively cash-poor.

It turns out that you can be rich on paper and not have easy ways to access that cash because if you sell a lot of your stock in your own company, other people see that and think “hmm, if he doesn’t believe in his company, why should I?” and the stock price goes down, because people think you know something they don’t. It’s a bad look!

Musk got himself in hot water last year - believe it or not, it wasn’t even about the pedo thing, it was a different set of bad tweets - and there was some speculation that he might have to pay his loans down if his company’s stock dipped too much, which would make it more difficult for him to take private jets to his office dozens of times a year.

When you’re rich, or banks think you may become rich in the near future, they give you nearly limitless lines of credit, which you can use to live as if you are actually rich. It’s a self-fulfilling prophecy! And if, by some unfortunate set of circumstances like, I don’t know, you happen to be running a giant real estate Ponzi scheme or cooking the books and your company isn’t worth what the banks imagined it might be, well I guess there are a few underwriters looking for new jobs?

Short Cons

ABC News - “A Texas man has been arrested after his fiancée saw a social media post of him robbing a bank the day before his wedding so he could pay for the ring and the venue of his ceremony.”

CNN - “…hundreds of thousands of consumers subscribed to Match.com shortly after receiving a fraudulent communication.”

NY Times - “As part of the settlement, which was filed Friday in Miami federal court, Mr. Falwell will pay an undisclosed sum to a young man who claimed he had been offered an ownership stake in a gay-friendly youth hostel”

As always, mash that subscribe button, tell your friends, and send me any hot scam tip so to scammerdarkly@gmail.com.