Tuna Fish

By now, you’ve probably read a news story or heard a joke about the tuna in Subway’s sandwiches. As a devoted chronicler of food labeling scams, I couldn’t not write about the New York Times piece about the tuna sandwich lawsuit:

Subway, for its part, has categorically denied the allegations. “There simply is no truth to the allegations in the complaint that was filed in California,” a spokeswoman wrote in an email to The New York Times. “Subway delivers 100 percent cooked tuna to its restaurants, which is mixed with mayonnaise and used in freshly made sandwiches, wraps and salads that are served to and enjoyed by our guests.”

When the WSJ detailed the vanilla lawsuit, I said this:

Look, I believe our consumer protection laws are woefully inadequate and lawyers should sue if they think companies are being dishonest.

[…]

…but it’s still dumb, and like most dumb things, lawyers are going to make a lot of money arguing about it.

The tuna lawsuit originally claimed Subway’s mixture contained no tuna. They alleged Subway was selling something else and calling it tuna. This argument seems a bit fishy to me, because canned tuna is already very cheap.

But! The tuna the Times reporter sent to a lab to get PCR tested - maybe they should have used a MassSpec pen, I am just saying - came back with no evidence of tuna DNA! Case closed! Or is it?

“No amplifiable tuna DNA was present in the sample and so we obtained no amplification products from the DNA,” the email read. “Therefore, we cannot identify the species.”

The spokesman from the lab offered a bit of analysis. “There’s two conclusions,” he said. “One, it’s so heavily processed that whatever we could pull out, we couldn’t make an identification. Or we got some and there’s just nothing there that’s tuna.”

Other outlets have tested Subway tuna and found it to be real tuna. Now, the plaintiffs in the lawsuit have changed their complaint, focusing now on the claim that the meat is “100% sustainably caught” tuna. Okay, sure.

If there is a degree of fish fraud going on, it’d be at the processing or cannery level. It’s unlikely Subway would have any knowledge of it. And, again, canned tuna is the absolute cheapest form of the fish, so it wouldn’t make sense for a distributor for the world’s largest sandwich chain to risk that relationship by slipping them the wrong meat.

Lawyers are going to make a lot of money arguing this case, and media outlets will garner clicks and eyeballs because these sorts of stories always capture the public interest, whether there’s any truth to them.

Crypto

Within the last week or so, two different cryptocurrencies crashed, for very different reasons.

First there was ICP:

The project, years in the works, generated a lot of buzz last month ahead of its initial coin offering, the crypto equivalent of a company going public and listing shares for investors to buy. In early trading after the market debut, the total market value of the Internet Computer token, or ICP, was worth tens of billions of dollars, making it one of the 10 most valuable cryptocurrencies at the time.

The ICP token is designed to help operate a decentralized layer of web infrastructure being built by Dfinity that believers say will liberate users from reliance on companies like Amazon and Google. The technically complex network would make it easier for people to build software and publish directly to the internet without going through the tech giants’ platforms.

Their goals were lofty, and sounded good to investors, who poured money into the currency in its crowdfunding phase. Then, when it came time for the ICO - initial coin offering - things went sideways:

Internet computer’s (ICP) price was changing hands at $34.63, down 0.44% in the 24 hours leading up to press time, according to Messari. The token’s value, according to TradingView, was once as high as around $630 when the ICP/USD pair went live on the U.S.-based crypto exchange Coinbase Pro on May 10.

That’s a loss of over 90% of its value within a few weeks. Not good! So what happened?

The process for claiming ICP tokens stands out, because “Dfinity did not follow the playbook of other successful projects,” Arkham [Intelligence] said. “Instead, it appears they quietly allowed the treasury and insiders to send billions of dollars of ICP to exchanges, while making it extremely difficult for their longtime supporters to access the tokens they were promised.”

According to forensic investigators, it looks like insiders - the coin had large investments from VC funds and others - were allowed to dump their coins into exchanges. Small investors were left holding the bag when the glut of supply tanked the coin’s value. It’s like an IPO on steroids - typically companies “lock up” or prevent large shareholders or employees from dumping company shares when they go public, because it drives the price down and makes everyone mad. In this case, because you can’t really prevent anyone from selling or trading crypto once you’ve given it to them, the whales dumped their coins for as much as $2 billion, and everyone else was left holding coins worth 10% of their peak value. Not great!

Then there’s WhaleFarm:

On Monday, something called WhaleFarm was trading above $200 on crypto exchanges. By Wednesday, it was worth close to zero.

It’s the latest easy-come, easy-go DeFi project to raise eyebrows, after its crash likely wiped out millions in value in a matter of hours, prompting Twitter lamentations on its obliteration and warnings from market pros on avoiding too-good-to-be true investments.

Oh, well, I don’t know what a Whale Farm is, but apparently a bunch of people thought it was a worthy investment. So what happened?

WhaleFarm was likely what’s known as a rug pull, a malign move that’s becoming more prevalent in the DeFi space whereby a developer abandons a project and absconds with the funds. In other words, the holder of the cryptocurrency in question dumps their stake all at once, leading to a catastrophic price drop that wipes out other investors.

Ah, right. We talked a little about liquidity pools last week, and how they can be vulnerable to…whales coming in and draining them. DeFi has made it easier for scammers to create legitimate-looking crypto projects, generate fairly large liquidity pools full of investor crypto, and make off with it. I’ll let this guy explain:

“The DeFi stuff in general, they pay huge yields but there’s massive currency risk,” said Justin Litchfield, who is the Austin, Texas-based chief technology officer at ProChain Capital, a crypto hedge fund.

In the case of WhaleFarm, the risk was 100%. Even ICP, backed by some of the biggest names in finance and investing, appears to have crushed most of its smaller investors. ICP fashions itself a real company and might have some potential legal risk, but WhaleFarm has likely moved on to a new spawning ground or whatever.

WinRed

I have written about the aggressive marketing tactics used by WinRed, the GOP’s current fundraising platform of choice. As of this writing both Facebook and Stripe, WinRed’s credit card processor, both seem to be fine with it, with Facebook saying political advertisers are allowed to use marketing tactics it forbids other advertisers from using:

Facebook, however, said that Section 6 does not apply to political ads that solicit donations. "Pre-checked boxes do not violate our policies for political fundraising," Facebook spokesperson Liz Bourgeois told Popular Information, "We’re taking a close look at how this fundraising practice is used on our platform to ensure that we protect the people using our services."

Shane Goldmacher, the NY Times reporter who has been writing about WinRed for awhile, has another article digging deeper into how it’s mostly seniors who are falling for aggressive fundraising tactics:

The findings, which looked at refundsin one large and diverse state, California, showed that the average age of donors who received refunds was almost 66 on WinRed and nearly 65 on ActBlue, the equivalent Democratic processing site.

Even more revealing: More than four times as much money was refunded to donors who are 70 and older than to adults under the age of 50 — for both Republicans and Democrats.

The Trump campaign and WinRed had a refund rate six times higher than the Biden campaign once they started using double prechecked donation boxes, but it’s worth pointing out that both political parties depend on the elderly for a large portion of their fundraising.

WinRed may be a worse offender, but the Democratic establishment’s fundraising machine includes dubious email shops like Mothership, whose clients had higher than usual refund rates . We talk a lot about how the elderly are the ideal target for disreputable firms looking to drain their remaining savings with breathless pleas to save the country. So what’s being done about it?

Amy Klobuchar has introduced legislation to ban pre-checked boxes. And, this week it was revealed that four Attorneys General have opened inquiries into WinRed and ActBlue, specifically into their use of prechecked boxes. State AGs have significant investigative and enforcement authority over consumer protections, which is really what this case is about - political parties should not have special dispensation to fleece seniors, especially when the behavior would be illegal for any other business. WinRed is arguing in court that the states have no jurisdiction over them.

The FDA

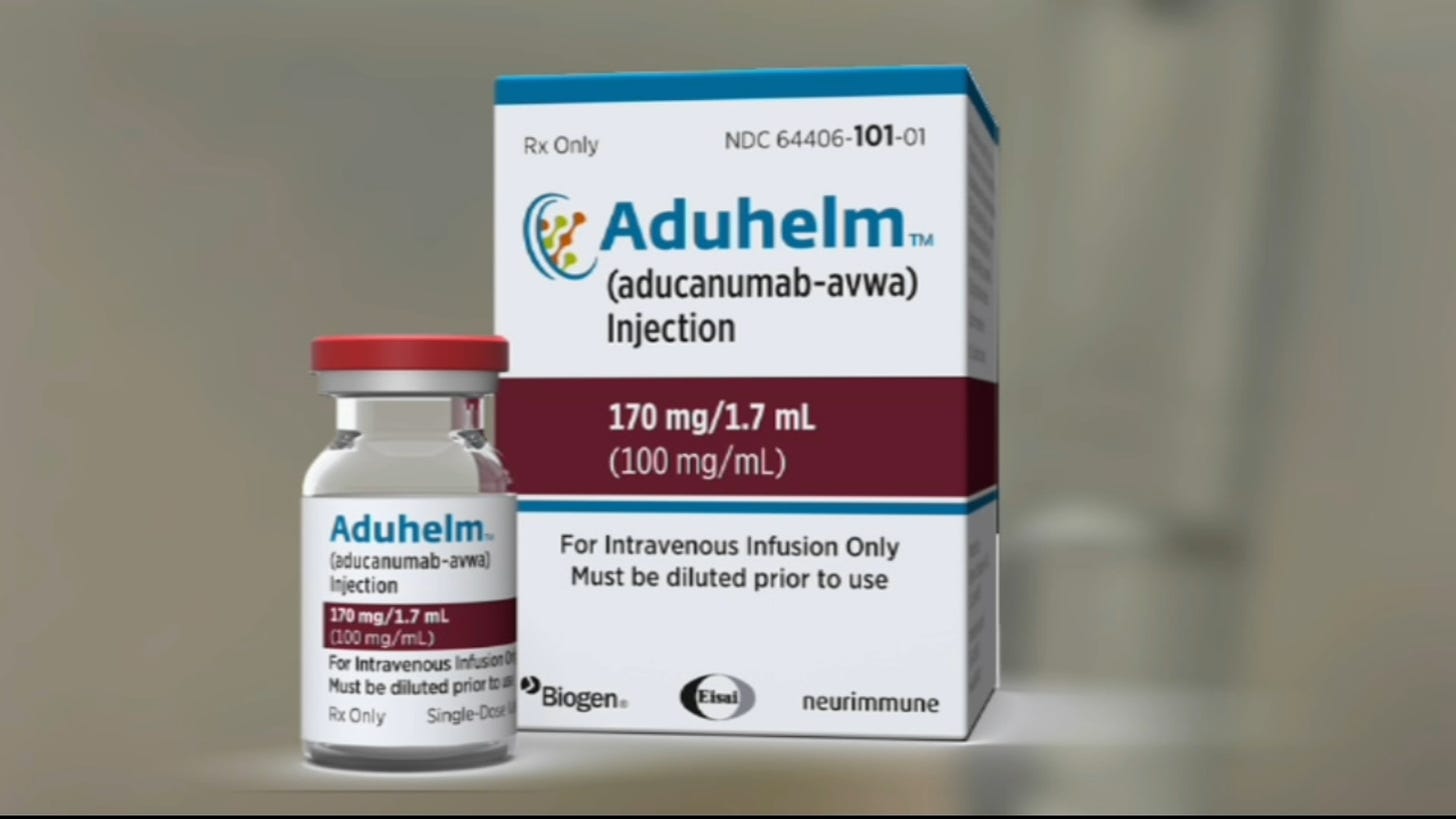

Facing sharp criticism for approving a controversial drug for all Alzheimer’s patients, the Food and Drug Administration on Thursday greatly narrowed its recommendation, suggesting that only those with mild memory or thinking problems should receive it.

The F.D.A.’s turnabout, highly unusual for a drug that has only been available for a few weeks, could considerably reduce the number of eligible patients. The initial label, saying the drug could be appropriate for anyone with Alzheimer’s, encompassed about six million Americans. Under the revised label, as many as two million Americans would likely be eligible.

I mean, it’s still not great - the drug isn’t actually proven to work for people with mild symptoms, but it’s something. This isn’t good news for Biogen, who now has to continue to study the effectiveness of the drug while not making hundreds of billions of dollars off scared seniors.

Hunter Biden

I often ask - is art a scam? What if, instead of a scam, it was a straightforward way to profit off your dad’s job?

White House officials have helped craft an agreement under which purchases of Hunter Biden’s artwork — which could be listed at prices as high as $500,000 — will be kept confidential from even the artist himself, in an attempt to avoid ethical issues that could arise as a presidential family member tries to sell a product with a highly subjective value.

I am not accusing Hunter Biden of starting a career as a “full-time artist” specifically to solicit bribe money from people seeking access to his father, but I dunno, man:

Under an arrangement negotiated in recent months, a New York gallery owner is planning to set prices for the art and will withhold all records, including potential bidders and final buyers. The owner, Georges Bergès, has also agreed to reject any offer that he deems suspicious or that comes in over the asking price, according to people familiar with the agreement.

As the piece points out, making the auctions transparent would probably be a better idea than hiding the names of bidders and buyers? Also, Artnet interviewed Hunter about his new calling:

While he has no formal training, Biden has been making art since he was a child. In recent years, the practice has taken on a more formal, serious turn and he now works as an artist full-time.

[…]

“I don’t paint from emotion or feeling, which I think are both very ephemeral,” Biden said. “For me, painting is much more about kind of trying to bring forth what is, I think, the universal truth.”

I don’t often read interviews with abstract artists - is this how they talk? You don’t paint from emotion, bro? Is there some other way to paint? Anyhow:

“The universal truth is that everything is connected and that there’s something that goes far beyond what is our five senses and that connects us all,” he said. “The thing that really fascinates me is the connection between the macro and the micro, and how these patterns repeat themselves over and over.”

Cool. Most of Biden’s paintings I’ve found pictures of are Untitled because naming things is very ephemeral, and they’re expected to fetch $75,000 to $500,000 each, for no particular reason. Even a guy named Painter thinks this is ridiculous:

“The whole thing is a really bad idea,” said Richard Painter, who was chief ethics lawyer to President George W. Bush from 2005 to 2007. “The initial reaction a lot of people are going to have is that he’s capitalizing on being the son of a president and wants people to give him a lot of money. I mean, those are awfully high prices.”

I am having a chuckle thinking about an oil and gas lobbyist explaining to his dinner guests why he has a Biden on his wall. “This Untitled really spoke to me about the connection between the macro and the micro,” he’d say, as Washington Post reporters nod politely.

Maybe it’s a little refreshing that a Presidential child can just, like, pick up a hobby and make a bunch of money off it? Are we embracing the cynical reality of our post-capitalist plutocracy? I need Hunter to help me find this universal truth.

Short Cons

ProPublica - “Chime, which provides app-based banking services to an estimated 12 million customers, has according to experts been generating a high rate of complaints, with 920 filed at the Consumer Financial Protection Bureau since April 15, 2020.”

WaPo - ““There is a dark-web or dark-side coupon group that is doing nothing but selling coupons that are fraudulently and sophistically made to resemble actual coupons by the manufacturers,””

WSJ - “Ransomware is to bitcoin as the Internal Revenue Service is to the dollar. Just as the taxman forces you to use dollars to pay your taxes, electronic ransom demands have been set in bitcoin, forcing companies, individuals and even some governments to use the cryptocurrency if they wish to regain control of their computer systems.”

David Gerard - “The El Salvador Bitcoin plan is blitheringly obviously a scam, and the only question is the details of the scam.

The prize here would be a small country’s stash of genuine US dollars. At least $150 million will be extracted via a trust that’s being set up as an interface between dollars and bitcoins.”

Tips, thoughts, or tuna subs to scammerdarkly@gmail.com.