The OCC

The Office of the Comptroller of the Currency is not a government agency that typically makes news outside the finance world. The OCC creates rules about how banks can lend money, among other things. During the Trump administration, the OCC had been very friendly with the banks, and the banks had been happy about it. In May of 2020 Trump installed a guy named Brian Brooks as acting head of the OCC, and everything seemed fine. Then, as he was about to leave his post, Brooks did this:

As acting head of the Office of the Comptroller of the Currency, Brooks finalized a rule Thursday that would force banks to lend to gun manufacturers, oil drillers and other controversial industries that some have refused to do business with. Brooks, who is stepping down now that he’s finished the regulation, has also angered banks by granting federal banking licenses to technology firms, potentially creating a new flock of competitors.

Setting aside the “tech firms can be banks now” issue which I am sure will come up in this newsletter in the future, the government telling banks they have to lend to industries they find objectionable seems…not very good. How did this come about?

The high public interest was likely attributable to Brooks himself. He publicized his effort through speeches, interviews and op-ed articles.

[…]

There was his article in Game & Fish magazine -- likely a first for an OCC chief -- that argued banks are harming hunters by “suffocating” gun manufacturers’ capital needs. “We can’t rely on all bank executives to be as strong and courageous as American sportsmen,” Brooks wrote.

I can understand why bank executives are objecting to the new rule, when their regulator is trashing them in hunting magazines. Anyhow, Brooks was very careful to limit the new rule to cover oil drillers and gun companies and not marijuana businesses, who still can’t get banking. There is hope for weed dealers, though, because the Democratic House has passed marijuana banking laws multiple times and it may come up again in a new relief bill under a Biden administration.

Farmers

Speaking of crops, a story in the Western Livestock Journal says 2020 was a great year for farmers, with net farm income increasing a staggering 43% over 2019. This is…unexpected to anyone who’s been reading news about food shortages and price increases during the pandemic, but there’s an explanation:

Farm cash receipts are expected to decrease nearly 1 percent to $366.5 billion, the lowest in over a decade. Direct federal aid increased 107 percent from 2019, when one-third of net income came from government support. Not including USDA loans and insurance indemnity payments, producers are expected to receive $46.5 billion from the government, the largest direct-to-farm payment ever, according to MarketWatch.

Ahhh, that’s right. The government gave them billions of dollars hoping they’d vote for Trump, but that didn’t work out. Now, I’m a fan of giving people money, especially during a massive economic crisis. However! Because the farmer bailouts were done in typical Trump administration fashion, they don’t appear to have done much to increase supply, as evidenced by long lines at food banks throughout the year and crops rotting in fields:

In Queens, New York, the lines snaking around a food bank are eight hours long as people wait for a box of supplies that might last them a week, while farmers in California are plowing over lettuce and fruit is rotting on trees in Washington. In Uganda, bananas and tomatoes are piling up in open-air markets, and even nearly give-away prices aren’t low enough for out-of-work buyers. Supplies of rice and meat were left floating at ports earlier this year after logistical jams in the Philippines, China and Nigeria. And in South America, Venezuela is teetering on the brink of famine.

Oxfam estimated back in August that deaths from hunger could exceed COVID-19 deaths by the end of the year, which is staggering. In addition to crops rotting because there aren’t enough workers to harvest them - a problem exacerbated by Trump’s immigration policies - some food waste was due to fragile supply chains:

The sudden shift away from restaurant eating, which in places like the U.S. used to account for more than half of dining, means farmers have been dumping milk and smashing eggs, with no easy means to redirect their production to either grocery stores or those in need.

There is good news, as the Biden administration has promised green cards for agriculture workers and has announced plans to revitalize the industry, but we as a country need to address the tenuous supply chains, labor markets, and farming practices that got us into this mess in the first place.

Carlos Ghosn

I have written about Carlos Ghosn, his fall from grace as the head of Nissan, his daring escape in a guitar case, and his bizarre PR campaign while in exile. Now, the whistleblower who set these wild events in motion has given testimony in the trial of another disgraced Nissan executive:

When asked why Mr Ghosn wanted to reduce his disclosed compensation, Mr Nada told the judges: “He didn’t want to be fired. If he paid himself what he wanted and that was disclosed, the French state would have felt obliged to fire him.”

That seems…reasonable. Ghosn is accused of concealing $88 million dollars in salary over 8 years, because I guess his bosses at Renault would have fired him if they knew he was paying himself 8 figures. That said! I feel like the trouble he’s now got himself in - he’s currently an international fugitive - is much worse than having your pay cut or being fired. But what do I know.

GameStop

Remember GameStop? If you spent any time in the 1990s you probably saw one at a local mall, or bought games there. My memories of GameStop are of trading in half a dozen Playstation for a single new title, which is a good illustration of my financial sense as a teenager. Anyhow! Since the pandemic hit, GameStop has been in the news for a variety of reasons. Back in March the company tried to claim it was essential retail so it could keep its stores open and endanger its employees and customers:

Instead of instructing its retail employees to stay home, GameStop also says it is “providing all our stores with the necessary supply of disinfectant materials and hand sanitizer” and only allowing employees to remain home “if they are sick and are experiencing any flu-like symptoms.”

GameStop had already been on the ropes, its stock was in the toilet and it’d closed 200 locations in 2019. So you’d expect that GameStop either got bailed out or went out of business in 2020, right? Well, you’d be wrong:

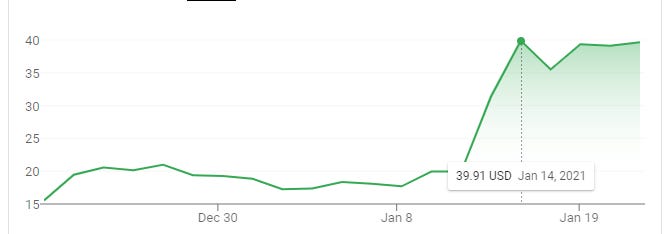

Nine months ago, GameStop stock bottomed out at $2.80 a share, a reflection of the myriad problems facing the retailer specifically and brick-and-mortar game retail as a whole. As of Tuesday morning, though, that stock price is hovering around $40 a share (peaking at $44.74 as of this writing), with the vast majority of those gains coming in the last couple of weeks.

Huh? It turns out there are a few things that happened to save GameStop. One was a substantial investment from a guy named Ryan Cohen who founded Chewy.com and has become an outspoken minority shareholder of GameStop:

Even as GameStop's earnings reports continue to be uninspiring, Cohen's bold talk about a new, less physical path forward for GameStop got some investors excited.

[…]

"[Cohen] seems to have a vision of what the company should be in the future," Telsey Advisory Group analyst Joseph Feldman told Ars. "It's more experiential, it makes sense given the changes in the market, so maybe it'll help speed that along. It's certainly something worth watching."

I mean…okay? That does sound like something. Perhaps investors aren’t aware there are lots of other companies who sell video games, and in fact Microsoft and Sony both have digital stores for their own consoles? I don’t know.

Ryan Cohen was one piece of the puzzle. Another piece was something called a “short squeeze”, which happens when a lot of people short a stock and it doesn’t go down as much as they’d expected - in this case, GameStop stock went up. Loosely speaking, people who sold GameStop short now had to buy a lot of its stock at higher prices, which drove the prices even higher, which made the stock look hot to other investors, who piled into the stock, driving it higher still:

"Demand started with some Robinhood-type retail investors, but once it started going up, then you had shorts that were like 'Oh shoot,'" [Michael] Pachter said. "And the shorts were getting killed, so they started covering. And that was a feeding frenzy. Light supply, heavy demand... so the stock's just getting ripped up... I've never seen anything like this in my life."

This culminated in the company’s stock doubling in value in two days last week:

Some analysts predict that another short squeeze - or more than one - could be coming as retail investors continue to buy the stock while another set continues to short the stock. On Reddit the WSB meme gang has taken credit for the recent chaos:

On Reddit on Thursday, WallStreetBets users were celebrating GameStop’s gains. Many posted screenshots of big wins from bullish options bets. Several talked about how they would spend their profits. One user posted that the experience demonstrates that the WallStreetBets forum “runs the market.”

So uh, what happens now? Some of the bigger investors, including at least one of Cohen’s allies, are getting out of the stock, thinking it’s likely at its peak. WSB posters are trying to push it higher. Shorts are continuing to bet on the company’s failure. But one thing to remember in all of this is that GameStop is not buying or selling these shares - they don’t suddenly have billions of dollars in the bank to go and build fancy new video game stores or start offering kids more for their used games. Nothing has materially changed about GameStop’s situation, and even the bullish analysts expect its stock to end up somewhere between $10 and $16 dollars when the hype dies down. The people making money off GameStop are investors - finance pros and Redditors - essentially rolling dice at the craps table. It’s a game of chicken, with each side betting on who will swerve out of the way first.

I often ask whether the stock market is a scam and, honestly, reading stories like this it’s hard to argue it isn’t.

Amazon

It’s been a couple weeks since I wrote about an antitrust case against a tech giant, but good news! Amazon is being sued for colluding with a group of large publishers to drive up e-book prices:

The suit, which was filed by the law firm Hagens Berman and is seeking class-action status, said Amazon charges high commissions and other costs to publishers, “which in turn significantly increases the retail price of the e-books they sell on Amazon.com.” As a result of the deal with the five big publishers, the price they charge on Amazon also has to be the price they charge everywhere else.

[…]

Calling it a “conspiracy to fix the retail price of e-books,” the suit alleges that the deal between Amazon and the five publishers—which it said account for 80% of all books sold in the U.S.—violates antitrust law.

The lawyers fighting Amazon do have precedent on their side - back in 2016 Apple lost a judgement for price fixing and had to pay $400 million dollars to people who bought e-books on its platform.

It shouldn’t surprise anyone that Amazon has explicit agreements with publishers to fix prices - pretty much the thing antitrust laws were created to prevent - though it remains to be seen whether private lawsuits will outpace legislators seeking to pass new laws to rein in the anticompetitive dominance of tech giants.

Digital News

Speaking of tech giants, the US government has been furiously lobbying Australia to halt work on proposed laws that would force Facebook and Google to pay for news sourced from local media:

In a submission asking the government to “suspend” the plans, assistant U.S. trade representatives Daniel Bahar and Karl Ehlers, suggested Australia instead “further study the markets, and if appropriate, develop a voluntary code.”

[…]

“The U.S. Government is concerned that an attempt, through legislation, to regulate the competitive positions of specific players ... to the clear detriment of two U.S. firms, may result in harmful outcomes,” said in (sic) the document

The issue at the root of the dispute is the share of ad dollars the two companies take while failing to pay organizations who report and produce the news:

The code followed an 18-month review by the Australian Competition and Consumer Commission (ACCC) Chairman and “extensive consultation” that included the views of both Google and Facebook, he added.

The ACCC inquiry found that for every A$100 of online advertising spend, A$53 goes to Google, A$28 to Facebook and A$19 to other media companies.

Following intense but unsuccessful lobbying of the Australian government from both tech giants to scrap the proposed laws, which they deem unfair, Google and Facebook have suggested they may be forced to limit their offerings in the country.

It does seem…unfair that the people who produce the news being read on Google and Facebook receive less than 20% of the revenue it helps generate. It’s also not the best look that any time Facebook or Google faces regulatory scrutiny in another country, they threaten to “limit offerings” in attempts to blackmail foreign governments. Not a thing you do if you’re truly providing a service that helps humanity, right?

I have said in the past I believe countries should start banning Facebook, and perhaps it will take more laws like the ones in Australia to show world governments that they not only don’t need American tech companies, but they’re better off without them.

Short Cons

Bloomberg - “Facebook Inc. will be making payouts to only about a quarter of the 6 million Illinois residents eligible for the biggest consumer privacy settlement in U.S. history.”

Vice - “The allegations against Nygard have yet to be proven in court, but the sheer number of stories raises questions about how someone accused of such reprehensible crimes might have avoided accountability for so long.”

Gizmodo - “Google’s core arguments on the privacy and power front are actually really similar in one specific way: They only ring true if you don’t actually question Google’s claims.”

The Nation - “By Cawthorn’s own telling, he was a successful business owner headed to the Naval Academy before his injury tragically reordered his life. As it turns out, neither claim is true.”

Tips, thoughts, or short squeezes to scammerdarkly@gmail.com.