Might As Well JUMP

In its flailing rush towards growth, Uber hasn’t only lit huge piles of rideshare and food delivery cash on fire, it’s also acquired a bunch of other companies along the way, and mostly destroyed them. One such company is JUMP, a bikeshare company Uber bought, horribly mismanaged, and sold for literal parts:

The JUMP bikes were being destroyed by the thousands and someone was posting videos of it on Twitter.

How did JUMP, once Uber’s big bet on bikesharing, get to a point where it was destroying perfectly good bikes because it couldn’t figure out anything else to do with them?

Ten years prior, a New Yorker named Ryan Rzepecki thought it would be a good idea to bring European-style public bikes to the US, and formed a company called Social Bicycles, or SoBi. Back then, the company would contract with cities, who would install and operate the quasi-dockless bike system - riders could either lock their bike to a SoBi rack, or use a public rack if needed. The SoBi team believed their road to success was paved with happy cities and riders, designing comfortable bikes and spending lots of time and money on urban planning.

Despite this attention to craftsmanship and the user experience, their early technology was…not good:

But the bikes barely worked. Miretsky remembers having to run around the airport to reboot the bikes’ onboard computers, which he described as “super 1.0 early beta technology that wasn’t working” in which the GPS and computer unit was attached to the bike with velcro.

There wasn’t much money working with cities, but SoBi labored on with the best of intentions - opening more cities and public spaces to the joys of cycling. The bikeshare world was still small until 2016, some competitors even working together on projects. Then came two Chinese companies, Ofo and Mobike, who showed up threw money at cities to let them launch dockless or “free lock” bikeshare operations, and started littering city streets with their cheap bikes:

“Freelocking turns the vehicles into trash and blocks the sidewalk,” one former JUMP employee said, “which is both bad for business and bad for cities.” It turns bikes into obstacles for people with mobility issues, the exact opposite of what bikes are supposed to be. And it sends the message that the bikes are disposable, have little value, and belong to no one.

Without the lengthy negotiating process SoBi and traditional bikeshare companies faced to enter new markets, the new dockless companies were limited only by the amount of investor cash they could raise. Ofo raised over $1.2 billion, Mobile raised $800 million, and they were off. Almost overnight, companies like SoBi, who had spent half a decade carefully building relationships with local governments, could no longer compete in markets they’d previous owned:

“They would go into markets we were just in with RFPs and said ‘we’ll pay you. How many bikes do you need? We’ll give you more,’” Miretsky recalled. “Cities said well great, this is no longer a problem for us to solve, the business community has solved it.”

SoBi, which soon rebranded as JUMP, did not want to pivot to free lock, as it went against their core principles. What Rzepecki did have was another competitive advantage - he’d spent 2 years developing an electric bike with a battery-powered motor. He believed the bikeshare industry would shift in that direction, and he was right. He got there first.

In 2017, JUMP needed investment to stay afloat. They took a meeting with Uber, who was about to boot Travis Kalanick out the door. Two Uber executives tested out the JUMP electric bike and were hooked:

“This was like the first time using an iPhone.” Shevelenko told Motherboard. “It just feels magical.” He had demo’d other bikeshare e-bikes in recent months, but the JUMP bike was far superior.

For a company who’d previously had major issues with technology, the JUMP e-bike was a coup. Initially Uber cut a deal to provide JUMP with access to investment capital and add the bikes into their app, but four months later they acquired the company for $200 million dollars.

Rzepecki was initially optimistic, believing that Uber’s vision for his company would help him share his dream of a bike-abundant society with more people. That lasted for, well, about a week or two:

Not only were JUMP employees no longer working on a shoestring budget, they barely had any budgets at all. Sleeping under the dining room table gave way to $400 per night hotel rooms. Like the Ofos and MoBikes they long decried, JUMP was now buying as many bikes it could get its hands on.

An Uber executive was put in charge, and her plan was growth at all costs. The company flooded the streets with bikes whether it made sense or not. Teams became overstaffed with tons of new hires. In the most critical error of the JUMP re-launch, Uber decided to put a flimsy cable lock on the new dockless bikes and, well:

All someone had to do was flip the 75-pound bike over and the cable would snap under its own momentum (there was also a method using a hammer that took more finesse). With a few well-placed blows, thieves could easily disable the GPS unit and be on their way with a (very heavy) bike.

Soon, JUMP bike theft and vandalism became rampant. People knew JUMP was owned by Uber now, and so they didn’t care about destroying the property of a rich start-up.

Uber’s financial difficulties increased, and layoffs hit JUMP staff. Then, in 2020, Rzepecki left. Soon after, Uber announced it was transferring JUMP to scooter start-up Lime, and most of the rest of the staff were laid off. Uber gave them an hour to say goodbye on Slack, then turned their computers off.

Ironically, bike sales have skyrocketed during the pandemic, with bike shops struggling to keep up. In Europe, reopening economies are reassessing how they get around - and cities are changing to better accommodate cycling and pedestrians. Why couldn’t Uber take advantage of this? Because, like all the gig companies, their solution was to overload the market with shit people didn’t need or want, throwing money at the problem without thinking about the consequences. SoBi and Rzepecki spent years planning a good way to get bikes into cities, and Uber managed to undo it in under a year. Impressive, really.

Fool’s Kingold

Kingold is a large gold processor in central China. Its shares are listed on the NASDAQ. The company took out large loans against its gold to expand the business and invest in other ventures. Now, it’s embroiled in a dispute with its creditors. Why? A lot of the gold they are sitting on is fake:

…at least some of 83 tons of gold bars used as collateral turned out to be nothing but gilded copper. That has left lenders holding the bag for the remaining 16 billion yuan of loans outstanding against the bogus bars. The loans were covered by 30 billion yuan of property insurance policies issued by state insurer PICC Property and Casualty Co. Ltd. (PICC P&C) and other smaller insurers.

Awkward! Kingold defaulted on some debts it owed, and when creditors showed up to seize the gold, they discovered much of it was fake. Understandably, they are now asking the insurer who said Kingold was good for the money whether they had actually checked to make sure it was, you know, actual gold. This seems like a basic function of property insurance, picking up a bar of gold to see whether it’s made of copper.

Kingold kept the ruse up for a few years, using money it borrowed against the gold to buy stakes in government-owned companies, and to get itself listed on American stock exchanges - unlike Luckin Coffee, Kingold is a cheap stock, and doesn’t appear to be running a scam on investors in markets, only its creditors back in China. Kingold was able to take out $2 billion worth of loans against its fake gold.

This story is wild out of context, but then I found out that gold is apparently a surprisingly common asset used to secure loans in China:

In the summer of 2015, a plainly dressed farmer claiming to be Yang Jun walked into the Rural Credit Cooperative of Tongguan County in Shaanxi province. He presented 26 shiny gold bars and applied to borrow 20 million yuan ($2.8 million) from the rural financial institution against the nearly 100 kilograms of precious metal.

The scene surprised no one at Tongguan Co-Op, which is supposed to serve rural financial needs in a county known for its rich gold reserves.

I, uh, what? Apparently in 2005 the Chinese government lifted restrictions on gold investment, and this happened:

…farmers carting in heaps of gold bars for loans became common at Tongguan Co-Op, a local source told Caixin.

The mental image is funny, but I have some questions. First question: did anyone check to make sure the gold in the wheelbarrows was pure? Apparently, no:

But confidence in the seemingly secure business suddenly collapsed in 2016, putting lenders’ careless handling of the booming business under the spotlight. The trigger was the 20 million yuan loan to Yang.

In April 2016 after failing to collect repayment from Yang, Tongguan Co-Op decided to melt his gold bars to sell the metal for cash. But as the shiny gold on the surface melted away, dark black tungsten plate appeared underneath. Tongguan Co-Op found that the bars pledged by Yang contained only 36.5% pure gold.

Classic Yang! It turned out that behind Yang was the founder of a gold refinery, who was using it to make the “adulterated” gold bars as a side business, and hiring local farmers to show up at banks with loads of the stuff:

A person said the Zhang brothers figured out a method for producing gold bars using tungsten, which weighs almost as much as gold. The bars look exactly the same as standard gold bars but contain only 36% pure gold.

Banking regulators where, to put it mildly, a bit lax in their oversight:

There were hundreds of borrowers from neighboring villages ages 18 to 80 applying for loans with gold at Tongguan Co-Op. With the money flowing to only five accounts, “how come professional credit officers didn’t raise questions on this?” a financial industry source said.

They don’t appear to have learned much since then, since Kingold was able to raise billions in loans with gilded copper bars. Ah, China.

Hush, Puppi

I talk a lot on here about not putting your crimes in writing. Also not posting the evidence on social media. This story, about a Nigerian man with a lot of Instagram followers, made it into the mainstream news, because people love a story about someone with millions of followers, I guess. Buried in this fluff piece, however, is this criminal complaint. Let’s read that instead, shall we?

Ramon Abbas, aka Ray Hushpuppi, aka Hush is a Nigerian national charged with a variety of cybercrimes, but mostly business email compromise schemes - BEC - which I’ve written about before. He also laundered a lot of money through foreign bank accounts, which is the thrust of the complaint.

Anyhow, Hushpuppi got popped when one of his co-conspirators - listed as number 1 in the complaint - had his cel phone captured by authorities and that became some great content for both an indictment and this newsletter:

Coconspirator 1’s iPhone listed Phone Number 1 with the contact name “Hush.” The phone also contained a contact for Snapchat username “hushpuppi5,” which listed the Snapchat contact name “The Billionaire Gucci Master!!!”

I mean, we know Abbas was not actually a billionaire, but it does sound like he was on his way there if he was laundering “tens, hundreds of millions” of dollars as the complaint alleges. DOJ really went into detail about the social media posts, which I’m not really sure is relevant to the case, but I am glad they did:

For example, on June 6, 2020, ABBAS posted a photograph of a white Rolls Royce Cullinan that included the hashtag “#AllMine.” On February 27, 2019, ABBAS posted a photograph of himself in front of two vehicles, one of which he described as his new Rolls Royce Wraith. Based on review of publicly available pricing information, the starting price for each of these vehicles is approximately $330,000.

Does a hashtag equal ownership now? Is this some form of digital squatter’s rights I’m not familiar with?

On numerous occasions, ABBAS posted photos of himself wearing items and/or holding shopping bags from luxury stores such as Gucci, Louis Vuitton, Channel, Versace, Fendi, and more.

Word of advice: this is why people hate cops! Saying someone took photos with nice clothing therefore…what? They’re a criminal? Give me a break. Where are the crimes?

Phone Number 1 was listed in the subscriber records of a third Apple account, which was created on November 7, 2019. The account listed the subscriber name “Godisgood Godson” and the verified email address godisgoodallthetime0007@gmail.com. Despite using that subscriber name, the name “Ramon Abbas”

Okay now you’re just dragging the guy. He really likes God, okay? Apparently what they are doing here is establishing that Abbas owns these various phone numbers and emails, which seems like a legitimate investigative practice. The Gucci and Rolls Royce posts, not so much. Like, come on:

I also saw a post, on October 11, 2017, by that Instagram account of a birthday cake with the inscription “Happy Birthday Ramon” and the caption “Thanks so much @gucci for this special. God bless you guys at the Dubai Mall Gucci Store!!!”

We get it, FBI agent, your job is mostly sifting through boring social media posts by international criminals. Don’t bore us with the details!

Eventually, the complaint gets into the meat of the crimes - Abbas and his crew stole $900,000 from a US law firm in a BEC scam. Then, they got their hands on €13 million Euros, and started talking about banks they could launder it through. They moved some of that money, and kept going with a steady stream of BEC scams:

It thus appears that Coconspirator 1 was telling ABBAS that coconspirators were fraudulently obtaining $1 million to $5 million through a BEC scheme once or twice a week, and was asking ABBAS for a bank account that could be used to receive such funds.

A few million a week in email compromise scams. No wonder Hush updated his snapchat profile. Their schemes culminated in a BEC attempt against an English Premier League football club, for around £100 million pounds. The back-and-forth involved in setting up hundreds of bank accounts around the world to launder millions through is exhausting, and I am sure the FBI agent in question felt the same. After many pages, he comes to an unsurprising conclusion:

For all the reasons described above, there is probable cause to believe that ABBAS has committed a violation of 18 U.S.C. § 1956(h) (Conspiracy to Engage in Money Laundering).

Yeah, I see it. Abbas’s lawyer says his lavish online lifestyle is funded by his work as an Instagram influencer and by “real estate” which, I mean sure. I do not know if there is a truly foolproof way to communicate with your criminal network when you’re moving tens of millions of dollars around the globe, but sending hundreds of photos and screenshots of your crimes across text and snapchat probably ain’t it. Also, maybe chill with the Instagram flexing. I am just saying.

Lie of the Tiger

The Republican nominee for Senate in Alabama is a guy named Tommy Tuberville. He was boosted by Trump, and he beat out the loathsome Jeff Sessions in the primary. Tuberville is best known as a former football coach who wasn’t particularly good at coaching, but in between coaching stints he ran a Ponzi scheme with a guy he met at fundraiser:

During a deposition in the civil litigation, Mr. Tuberville was asked if he had done “anything to check out” Mr. Stroud’s background before embarking on their business venture. He said he had not. “I just got to know him more as a guy hanging around, going out with us,” he said, adding that he had not even Googled him.

The “guy” was a man name John David Stroud, who was sentenced to 10 years in prison for doing the stealing money part of the Ponzi. Tuberville was the “T” in TS Capital Management and TS Capital Partners, but continued to coach football while his name was being used to push a multi-million dollar investment fraud.

Tuberville settled claims with bilked investors, and was never formally charged. While he was less active in the promotion of the Ponzi as, say, Jeffrey Epstein, one of Stroud’s former lawyers said he knew what was going on.

Seems about right that Alabaman Republicans’s choice to run against the guy who beat the guy who sexually assaulted young women is a terrible football coach who ran a Ponzi scheme.

Oh Shit, Almost Forgot About Twitter

In the week’s least interesting scam news, Twitter got hacked and a bunch of prominent accounts - Obama, Biden, Elon Musk, Bill Gates - tweeted out a Bitcoin scam. Twitter was unable to stop it right away, and briefly disabled posting by “verified” accounts, which was funny because all the people who use the blue check mark to feel important suddenly couldn’t.

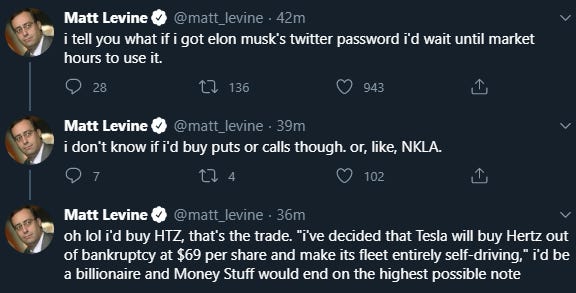

Matt Levine had the funniest take:

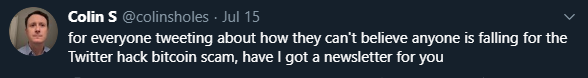

I had the most on-brand take:

The Bitcoin bandits only made around $100 thousand dollars off the hack, but more interesting was how it went down:

Twitter’s investigation into the breach revealed that several employees who had access to internal systems had their accounts compromised in a “coordinated social engineering attack,” a spokesman said, referring to attacks that trick people into giving up their credentials.

The hackers hacked Twitter employees and used their internal tools to impersonate celebrities and politicians. With an election looming, and disinformation flooding every corner of the internet, this seems like a good omen.

Short Cons

Bloomberg - “HSBC is among 23 banks owed almost $4 billion by Hin Leong, one of the largest traders in Singapore before its collapse in April following a plunge in oil prices that exposed what the report found were “manipulated” accounts and frequent double counting of cargo to keep credit lines flowing.”

Motherboard - “Police monitored a hundred million encrypted messages sent through Encrochat, a network used by career criminals to discuss drug deals, murders, and extortion plots.”

ProPublica - “PG&E overlooked a contractor’s involvement in illicit dumping before hiring it to clean up after the Camp Fire, the deadliest wildfire in California history. PG&E later accused the vendor of fraud for bribing employees and overcharging for services.”

NY Times - “North Korean and Chinese citizens are operating a multibillion-dollar money laundering scheme to help fund the North’s nuclear weapons program, the Justice Department said in an indictment”

Tips, comments, and Elon Musk’s Twitter password to scammerdarkly@gmail.com