House of Coins

Vaccine Tourism, Cruise Ship Suicides, Tether, Amazon, Fraud Honey, and RobinHood

Vaccine Tourism

Since the COVID-19 vaccines started receiving FDA approval in December, it’s been a mad rush to try to get needles in arms before doses expire. We know from the news that the Trump administration had no real plan to distribute vaccines, in most cases leaving it up to states and local health officials to figure it out. So, over a month in, how are those states doing?

Well, some are - surprisingly - doing quite well. West Virginia was the only state to shun a federal partnership with big pharmacy chains and had the best rate of vaccination through January. West Virginia! Then there’s Florida. Oh, Florida:

Visitors from Toronto to New York to Buenos Aires have long flocked to Florida for sun, surf and shopping. Now they are coming for the Covid-19 vaccine.

Some of the arrivals are Americans or foreigners who own second homes in the state and reside here part-time. Others are making short-term visits, seizing the opportunity provided by Florida’s decision to make the vaccine available to people age 65 and older, including nonresidents.

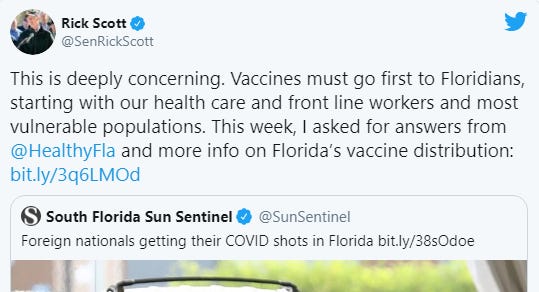

Yes, that’s right. Noted idiot Ron DeSantis signed an executive order allowing people who do not live in Florida to get vaccinated. And, unsurprisingly, many of them did! After a month of pressure DeSantis finally reversed course late last month, sort of:

Beginning today, anyone wanting to be vaccinated in Florida must be able to prove at least part-time residency in the state by showing a Florida ID or a utility bill.

“You got to live here, you know, either full time or at least part time,” said DeSantis.

Then there’s California. Variety details the mad scramble by Hollywood elites - not accustomed to waiting for anything - to get vaccinated before the rest of the public:

Numerous high-flying executives and dealmakers have been cycling through private physicians and concierge services to receive one of the two established COVID-19 vaccines on the market. Others have been tapping their vast resources in a mad dash to get vaccinated as the government, especially in Hollywood’s native California, churns through a sluggish rollout.

It’s true California has done a lousy job getting vaccines distributed:

While the state expanded its vaccine criteria last week, availability of the shots continues to be an issue nationwide. Los Angeles County has one of the lowest immunization rates in the U.S. Residents started caravanning to Dodgers Stadium to wait hours for the vaccine.

But - as I predicted a month ago - it’s not surprising the wealthy are trying every trick in the book to skip the line, leading to some…amusing anecdotes?

One witness on hand saw a top Hollywood dealmaker idling for so long in line with the general public last Tuesday, they feared the individual’s Tesla Model X would run out of battery power.

Oh no! The article talks about how elites view the vaccine chase as a “life or death” matter, which I’m sure isn’t how they view putting service workers or film industry employees at risk every day on their behalf, but hey. Thing is, they could just I don’t know stay home a few more weeks until it was their turn, but why would they, right? Hollywood - and capitalism more generally - is about climbing over people to get to the top. Why would a vaccine be any different?

If you’d told me two months ago that West Virginia would lead the nation in vaccine distribution and California would be one of the worst I’m not sure I’d have believed you, but here we are.

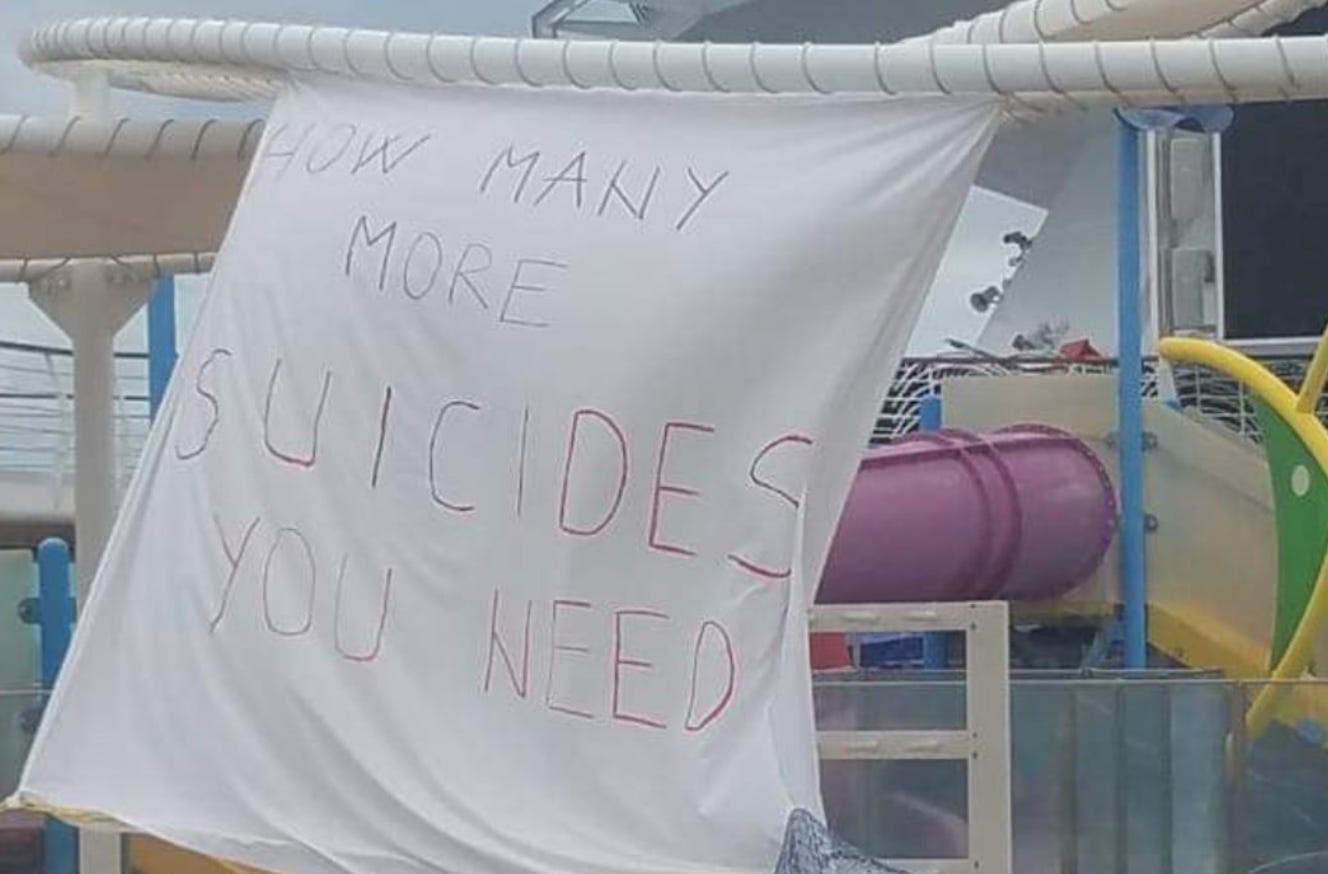

Cruise Ship Suicides

There’s really no way to soften this - cruise lines trapped employees on ships for months during the pandemic, and some of those employees killed themselves. It’s a grisly topic, and the Bloomberg piece goes into great detail about what happened on the ships, so read it with that in mind.

I wrote about Carnival last spring, when they were teasing a restart as early as August. They’re a bad company run by bad people - read this piece if you’d like to know more. Now, we’re learning about what conditions were like on cruise ships during the pandemic, and it’s horrifying:

Separated from families, confined mostly to tiny cabins, with no obvious legal recourse and at times no pay, sailors experienced a more extreme version of the household lockdowns that have sent people tumbling into depression.

[…]

It wasn’t just the claustrophobic environment that was distressing. Workers say cruise companies constantly changed repatriation schedules, offering only vague guidance on when or how they’d return home. Without customers on board, Carnival moved many contractors off duty, meaning they could sort of enjoy the amenities of the ocean liners. But that also meant their salaries were eventually cut off—a scary situation for those supporting families on land. The weeks dragged on with limited entertainment options. Internet access was complimentary on some boats, but it could be painfully slow or strong enough only for social media and texting.

I have never been on a cruise, but I imagine normal cabins are cramped on a good day. I mean, you aren’t boarding a cruise ship to sit in your room for 20 hours a day, but cruise lines locked their ships down for fear of virus spread. When employees were allowed to leave their rooms, it was handled poorly:

Life on the Magic was regimented. Workers were allowed outside their cabins only during set times, were required to wear masks, and had mandated curfews. About an hour was allotted for breakfast, but the lines were slow and crowded. It could take 45 minutes just to get a coffee.

[…]

Life on the Breeze that May was still structured—Carnival issued a precise timetable dictating when crew could leave their cabins for food or a twice-daily “60 min fresh air break.”

On top of this, cruise lines spent months promising they’d return employees to their home countries, only to encounter an ever-changing set of health guidelines. Crew were transferred between ships by lifeboat in attempts to get them home. Cruise lines booked flights and cancelled them, leaving workers in a state of constant uncertainty. On some ships, bars offered unlimited alcohol in lieu of mental health services.

The cruise industry has a lot of problems, and the pandemic put their terrible treatment of workers on full display. I feel like “deaths on board covered up by cruise ship company” is an overused TV plot, but this story makes clear it’s all too real of a problem, and the cruise industry has a lot of work to do to clean up its legacy of bad corporate behavior.

Tether

Cryptocurrency has been in the news lately, and I came across this anonymous medium post about Bitcoin and Tether, which led me to this article in The New Republic about how Tether may be a scam to inflate the value of Bitcoin and enrich crypto investors. Let’s dive in!

Tether is a “stablecoin” which means it’s supposed to be pegged to the US dollar at a 1-to-1 ratio. Also, unlike many cryptocurrencies, Tether is controlled by its parent company, Tether Limited, and can mint as many coins as it has dollars in the bank. Or so the company says, but many people dispute this:

High-powered lawyers, jaundiced traders, rogue economists, industry whistleblowers, crypto gadflies, and several U.S. law enforcement agencies claim that Tether is part of an elaborate scam that essentially boils down to using the company’s in-house currency to buy Bitcoin, which has the intended side effect of juicing the price of Bitcoin, and to otherwise manipulate cryptocurrency markets.

So why is Tether so important? Our anonymous blogger breaks it down:

The left-hand side of this chart shows which currencies are flowing into Bitcoin (that is, are being used to buy Bitcoin) across all crypto exchanges. The right-hand side shows which currencies are flowing out of Bitcoin (that is, that Bitcoin is being used to buy). The chart is showing typical numbers for early January 2021.

The upshot: over two-thirds of all Bitcoin — $10 billion worth of it — that was bought in the previous 24 hours, was being purchased with Tethers.

How is this possible? The answer is that while some crypto exchanges - Coinbase is the largest in the US - do not accept or trade Tether, the three massive “unbanked” exchanges which account for the vast majority of Bitcoin trades operate almost exclusively in Tether.

This would be fine, if Tether was sitting on $10 billion dollars in its bank accounts, with every Bitcoin trade it facilitated covered by fiat currency. But, well, there’s actually no evidence it is:

Tether had long claimed that for every USDT it put into circulation, it would have one U.S. dollar in the bank. But after years of evasions and refusals to release a complete audit of its finances, a Tether lawyer finally admitted, in a 2019 court filing, that Tether was only 74 percent backed—a number that seemed to include cash, securities, Bitcoin, and other money owed to Tether. Tether’s continued refusal to fully audit itself, combined with its feverish printing of new coins, has led many critics to question even this 74 percent number.

Tether has had quite a few scandals in its short life - things that sound familiar to anyone who covers Ponzis and sham companies. Their sister company Bitfinex claims it was ripped off to the tune of $850 million dollars by Polish scammers. Banks cut ties with Tether, repeated “hacks” caused losses across exchanges, and through it all, Tether kept printing more and more coins.

The exchanges who do accept Tether seem to be in on it as well - they offer leverage trading and special giveaways and promotions, meaning that in exchange for real Bitcoins they’ll give you anywhere from 2 to 100 times the amount in Tether to trade. This, again, would be fine if Tether really had the cash reserves to cover it. But what our anonymous blogger thinks is more likely is that Tether and its associated exchanges are taking customer Bitcoin, issuing not-actually-stable Tethers, and letting traders inject those back into the Bitcoin ecosystem, stimulating more demand and driving the price of Bitcoin higher and higher.

What seems more likely - that Tether has grown to hold $25 billion in assets in a couple years as investors put millions of dollars a day into its currency despite repeated claims of fraud and shady dealings, or that Tether’s owners are siphoning off significant amounts of its crypto for themselves as the price of Bitcoin skyrockets, which is why no one can redeem Tethers for dollars and they refuse to disclose their finances? I know which version my stabledollars are on.

The scam may come to an end soon, as the NY Attorney General’s office is processing the reams of documents Tether and Bitfinex have turned over to them. A guy in the WSJ opines:

I was pointed to the original filing for the scope of the investigation. It includes an accounting of all of Tether’s transactions. On Jan. 19, a letter from iFinex’s counsel said it had “largely completed the document production” and would “contact the Court in approximately 30 days” with a status update. So we’ll know something soon.

Meanwhile, lo and behold, around the same time as that letter, Tether temporarily stopped creating any more currency. That might explain bitcoin’s quick mid-January price drop from $42,000 to under $30,000. If fraud is uncovered, look out below.

Amazon

While the news has been dominated by the Jeff Bezos announcement - ironically, by stepping down as CEO and remaining chairman of Amazon he’s going to become more powerful while subject to far less scrutiny - Amazon also agreed to pay $61.7 million dollars to settle allegations it stole tips from its delivery drivers:

When Amazon launched its Flex program in 2016, the company regularly advertised that independent contractors who deliver packages in its Flex program would receive "100% of the tips" they earned and would be paid between $18 and $25 an hour, according to the FTC complaint. But shortly after it launched, Amazon quietly changed course and began slashing its payments to drivers and cutting into their tips to make it appear as if it was still paying the promised hourly rate, according to the FTC.

Remember Amazon Flex? Flex drivers are Amazon’s fleet of gig workers - they are independent contractors who provide their own vehicles and do not receive benefits. Tips were, understandably, very important to these drivers. So in addition to all the other humiliation Amazon inflicted on these people, it was stealing from them to keep their pay artificially low. Very cool.

In 2019, when they realized they got caught, they suddenly became more transparent:

Amazon used this model until 2019, when the company received notice of the FTC's investigation. At that time, it began to give drivers a breakdown of both their pay and tips.

In addition to the $61,710,583 Amazon must pay to compensate shorted drivers, the company will be prohibited from misleading drivers about their expected pay, the percentage of their tips that will go to them, and what qualifies as a tip.

Jeff Bezos made an estimated $150,000 per minute pre-pandemic, which means he’d have to work 7 hours as chairman of Amazon to cover this settlement.

Fraud Honey

It’s hard out there for a honeybee. Everything in the environment seems to be trying to kill you. Mites are a eating your insides, though scientists are trying to help toughen you up. Humans are murdering you for almond milk. While many beekeepers are doing their best to keep you alive to provide the world with delicious honey, China is trying its best to ruin that too:

Many of Mexico’s estimated 42,000 beekeepers – much of whose honey goes to Europe – are now giving up and abandoning their hives.

Moo Pat blames China for his financial plight. There, cheap honey and sugar syrup are produced on an industrial scale and blended together by fraudsters. Beekeepers believe this adulterated honey is responsible for saturating the market, crashing global prices and deceiving millions of customers.

Come on! I know China’s approach to global trade is growth at all costs and market domination, but bees are, like, important to our survival as a species? One of the problems with detecting China’s fake honey is that “honey” itself is difficult to define:

Honey is not just a single consistent substance. Instead it’s a complex mix of sugars which vary according to the region it comes from, the flowers it is derived from and the time of harvesting. Designing a test that can work across a range of honeys and pick out the adulterated ones is a serious scientific challenge.

This makes sense. Flowers are different all over the world, so why shouldn’t the sugars in honey be equally varied? Apparently the UK buys a lot of China’s adulterated honey, and there’s probably a joke about British taste buds to be made here, but it’s a serious problem:

Ten out of 11 products – including own-brand honey from Tesco, the UK’s biggest supermarket – failed the NMR tests because of suspected sugar adulteration. None of the 11 samples passed all the authenticity tests.

In 2020, 13 honeys were subjected to another battery of tests. Nine of the products contained psicose, the rare sugar which would not typically be found in honey. Ten of the 13 honeys tested positive for the presence of enzymes indicating that they may be “adulterated with syrup”. All of the 13 honeys failed the NMR test.

So China is flooding a quarter of the global market with fake honey, pushing independent beekeepers out of business, all while science is struggling to maintain the honeybee population because it’s under threat from all sorts of other dangers? Fantastic. I hope they find a test that works soon - the British will be thrilled once they discover what real honey tastes like.

RobinHood

Don’t worry, this isn’t about GameStop! Or, it’s mostly not. Instead I want to talk about what happened to RobinHood last week, and why it had to restrict trading on meme stocks at the peak. Many people - myself included - speculated there might be market manipulation going on, but, as with most things finance, the answer is somehow both boring and stupid.

Essentially, what happened last week was RobinHood’s “clearinghouse” - the firm who handles all the money for RobinHood’s trade volume - raised its capital requirements because…it felt like it?

Wild price swings in a number of stocks prompted the clearinghouse that processes and settles its trades to ask Robinhood for more cash to cover potential losses on the transactions.

Because of a lag between when investors book new positions in a stock and when their cash is actually exchanged for securities, brokerages like Robinhood have to maintain deposit accounts at the clearinghouses that help finalize trades. The Depository Trust & Clearing Corp., which operates the main clearinghouse for U.S. stock trades, requires brokerages to post more of their own money in riskier times to insure against losses.

The “lag” referenced here is what’s known in industry parlance as T+2, meaning it takes two days for money to actually exchange hands between brokerages for stock trades. That means the shares of GameStop someone bought on Tuesday would actually be loaned until Thursday. And, when stocks get very volatile, a lot of…stuff can happen in two days.

The thing is, Robinhood is a brokerage, and is not the entity buying or selling any of these securities. As Matt Levine puts it:

So far Robinhood was on the right side—it wasn’t even on a side, it was selling pickaxes to the people who were on the right side—and was forced to raise $3.4 billion.

This is correct, to an extent. One thing RobinHood does, which is a reason it’s so popular, is allow its users to trade on “margin” accounts, which essentially means they do not own the stock, but instead RobinHood is promising them that their trades will execute and the requisite amount of money will appear in their account balance. If you’d like an exhaustive explanation of the things that occur behind the scenes this is a good Twitter thread.

Anyhow, one of the reasons RobinHood is so easy to trade on - and has no fees - is that RobinHood is removing one layer of complexity from securities trading and functioning as a lender to most (all?) of its users. The downside to this is that if enough of its users get into trouble - say, they buy options in a stock that is wildly volatile and then cannot cover the losses - RobinHood is on the hook for that money.

Why does any of this happen this way? It’s 2021, computers are fast, why do we have companies like DTCC sitting in the middle of stock transactions and deciding RobinHood has to suddenly pony up $3.4 billion dollars? I mean, the answer is, realistically “so everyone can charge more fees and bankers make more money” but in this case this clearinghouse, which operates with relative autonomy, could have put RobinHood out of business and screwed millions of its customers - remember, they don’t actually own the stock, and they’d become creditors if RobinHood went bankrupt, probably getting pennies on the dollar for their account balances in court.

Regulators are partially to blame for this, as this piece from 2014 explains:

The deep issue here is that clearing houses are the choke-points of financial trading. This is going to be even more the case going forward, as regulators have insisted that more and more markets should be centrally cleared.

[…]

But I worry, quite a lot, that people are kind of missing the point. The problem with clearing houses is really not the remote, theoretical (although admittedly horrifying) risk that one of them might suffer a counterparty default which forced it into insolvency. The problem about clearing houses is that the ways in which they protect themselves against credit risk tend to have the effect of radiating liquidity problems out into the rest of the system.

The “liquidity problem” facing RobinHood was not that it couldn’t cover its own customer buying and selling activity, it was that DTCC decided it wanted $3.4 billion more dollars and RobinHood had to scramble to raise that money in a matter of a couple days, which meant it had to cut some unfavorable deals with its investors.

It turns out the cause of last week’s crisis wasn’t evil hedge funds, Redditors, or tech executives. It was a handful of people at a stock clearinghouse - a thing most people didn’t know existed until this week - putting a dollar figure on the implied risk of a few stocks. Isn’t our financial system great?

Also, RobinHood has some thoughts on real-time settlement.

Short Cons

KTLA 5 - “The former CEO of Make-A-Wish Iowa has been arrested on felony charges alleging she embezzled tens of thousands of dollars from the charity that supports sick children, the group confirmed Friday.”

NY Times - “Six years later, residents of the exclusive tower are now at odds with the developers, and each other, making clear that even multimillion-dollar price tags do not guarantee problem-free living. The claims include millions of dollars of water damage from plumbing and mechanical issues; frequent elevator malfunctions; and walls that creak like the galley of a ship…”

WaPo - “The complaint alleges the ingredient billed as “tuna” for the chain’s sandwiches and wraps contains absolutely no tuna. A representative of Subway said the claims are without merit.”

WSJ - “The schemes, the authorities said, disproportionately targeted the elderly and other vulnerable individuals. Employees of Epsilon Data Management LLC, the data company Publicis bought in 2019, continued to sell consumer data to clients engaged in fraud even after, in some cases, they knew that those and similar clients had been arrested, the Justice Department said.”

Tips, thoughts, or late harvest honey to scammerdarkly@gmail.com