Suitcases of Cash

Tracking global money laundering is hard. There are dozens of non-profits dedicated to the task, and every major law enforcement body in the world claims to be working on it. The United Nations estimates that the amount of money laundered each year is somewhere between $800 billion and $2 trillion dollars. What if we could create a natural experiment to find out how much money is being laundered through a country?

Good news! The global pandemic has done exactly that in Latvia:

Based on deposits by commercial lenders at the central bank, Latvia had thought that about 400 million euros ($450 million) was being smuggled in each year. Recent border closures to curb the spread of Covid-19 are confirming those suspicions.

“Suddenly, there wasn’t this cash,” Ilze Znotina, who heads the financial intelligence unit, said in an interview in the Baltic nation’s capital.

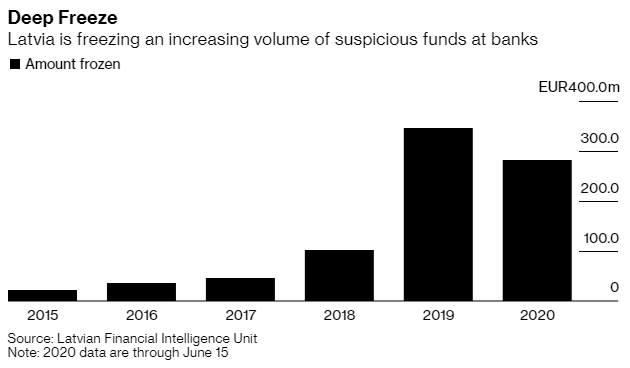

Cleaning up money laundering has become a central mission of the newly elected Latvian government, with the country at risk of being put on a “gray list” of money laundering hubs by the US government. In 2018, corruption scandals at two large Scandinavian banks led to the arrest of the Latvian finance minister. Since then, the country has frozen huge amounts of suspect cash amid reform efforts:

Authorities made it more difficult for illicit funds to be transferred electronically into the country, so the criminals have resorted to bringing it in the old fashioned way, in suitcases:

When customs agents in Riga followed a tip and searched passengers arriving on a private jet from Ukraine last year, they hit the jackpot. Luggage belonging to the four travelers contained about $1 million in U.S. and European banknotes.

[…]

Elsewhere, law enforcement is keeping tabs on people arriving and departing as often as 15 times a year, sometimes with their entire families in tow -- including children. Each carries an amount just short of the 10,000-euro threshold for declaration.

But then, COVID happened, and travel into the country all but stopped. So did the cash. A lot of people are sitting at home, suitcases full of Euros, really sweating the new WHO guidelines.

Mafia Bonds

Speaking of money laundering, here is a Financial Times exposé on an Italian mafia clan called ’Ndrangheta, who stepped into the void left behind by the Cosa Nostra crime family out of Sicily in the 1990s. Unlike a traditional top-down crime “family” the ’Ndrangheta operates as a network of independent gangs, splinter organizations that control their own areas. As a collective, they have expanded offshore and built a global crime empire, originating from a small province in Italy. In recent years their estimated global profits have dwarfed the powerful Latin American drug cartels.

This story, though, focuses on two things: mafia looting hospitals in their home province of Calabria, and that money being funneled into international banking markets and packaged into…bonds? Okay. First, the hospitals:

By corrupting local officials, organised criminals have been able to make vast profits from contracts given to their own front companies, establishing monopolies on services ranging from delivering patients in faulty ambulances to transporting blood to taking away the dead.

All these services were billed to the Italian taxpayer through the country’s centrally funded yet regionally administered health service, which distributes an annual budget of billions of euros — an unrivalled prize for criminal gangs. So tight was the clans’ grip that doctors in Lamezia Terme reported having to wait outside a hospital ward for men from the ’Ndrangheta to open the locked door with their keys.

Jesus. Mafia gangs forced grieving families to use their funeral services, accessing medical records and targeting relatives of people with serious illnesses. They threatened people who refused their services. And, they billed all of it to the Italian government.

What did they do with the money? Some of it made its way to London and Milan:

Over the past five years, profits gained from the misery of patients in Calabrian hospitals were packaged up into debt instruments using the kind of financial engineering typically favoured by hedge funds and investment banks.

Matt Levine calls them “extortion bonds” and while I’d argue that sounds an awful lot like Goldman’s foreclosure buying program too, these were decidedly more illegal. How did it work?

From 2015 to 2018, hundreds of millions of euros of invoices signed off by officials in Calabria’s cash-strapped municipal health authorities were purchased by intermediaries. These middlemen bought the unpaid invoices from suppliers at a steep discount because they were, in effect, guaranteed by the Italian state. They were then sold on to specialist financial companies, who merged them into pools of assets and sold investor bonds backed by the unpaid bills.

[…]

Front companies for organised crime working in the Italian healthcare sector managed to offload invoices owed to them by regional health authorities to unwitting intermediaries, who then sold them on again to legitimate financial companies. They then packaged them into specialised debt products marketed to investors hungry for exotic higher-yielding bonds at a time of record-low interest rates.

[…]

None of these bonds was rated or assessed by major credit rating agencies or traded on financial markets. Instead, some were privately placed by boutique investment banks, several of which have offices in Mayfair or the City of London.

They repackaged debt owed to the literal mafia so investors could get their hands on “exotic” high-yield bonds. The bonds weren’t rated, or apparently audited by anyone. Sounds right. Meanwhile, the human toll it was taking in Calabria was stunning:

Italy has one of the highest life expectancies in the world, but the region’s health statistics are among the worst in Europe. The average number of years that Calabrians enjoy good health stands at 52.9, according to Italy’s statistical office, lower than both Romania and Bulgaria. A resident in the wealthy northern Italian region of Bolzano, by comparison, enjoys on average 70 years of good health. Calabria also has the highest rate of infant mortality in Italy, while tens of thousands of “health refugees” leave the region each year to get treatment in better hospitals in the north.

Stories like this show how difficult it is for countries to get out from under the influence of powerful organized crime. If it’s not literal extortion, it’s money laundering. If it’s not money laundering, it’s the pressures of financial markets - rich investors chasing big returns through risky investments. Beneath the spreadsheets are real people, trying to go to the doctor or hospital, or live their lives in a world with fundamentally broken incentive structures.

All About the Washingtons

Typically, when I write about counterfeit things, it’s sneakers or products on Amazon. But, once upon a time, people creating fake money was a lot more common - these days it’s dominated by fake money rings in Peru. India recently took 2 of its most commonly used bills out of circulation due to rampant counterfeiting. The murder of George Floyd was over a suspect twenty dollar bill.

Typically, counterfeiters go after larger bills - twenties or hundreds. Back in the 1930s, one man took up counterfeiting for a different reason - to put food on his table. Rather than creating large denominations, he made dollar bills, and used them sparingly, to buy provisions from local stores in New York. Hilariously, this led to the most extensive counterfeit investigation in US history:

One morning in November of 1938, [Emerich Juettner] snapped pictures of a $1 bill, transferred the images to a pair of zinc plates (using, among other things, a bath of acid), then meticulously filled in small details of the bill by hand.

On a small hand-driven printing press in the kitchen of his brownstone flat at 204 W. 96th Street, he began minting fake $1 bills.

Back then, counterfeiting was difficult and expensive, and it was easy to get caught trying to pass off the fake bills. Juettner took a…different approach:

…[the] bill was so poorly done that the Secret Service thought the perpetrator was intentionally mocking them.

It was printed on cheap bond paper that could be found at any stationary store. The serial numbers were “fuzzy” and misaligned, the Secret Service later said. George Washington’s likeness was “clumsily retouched, murky and deathlike,” with black blotches for eyes.

And just for good measure, the ex-president’s name was misspelled “Wahsington.”

Amazing. His fake bills were so bad it drove Secret Service investigators crazy. They thought he must be taunting them, daring them to catch him. In reality, it was Juettner’s buying habits that kept him one step ahead of the law for a decade:

He seemed to use his bills just enough to survive, never passing off more than $15 per week. He also never spent money in the same place twice: His “hits” spanned subway stations, dime stores, and tavern owners all over Manhattan.

[…]

By 1947, the Secret Service had documented some $7,000 of the distinctively terrible fake $1 bills — about 5% of the $137,318 of fake currency estimated to be in circulation nation-wide.

Finally, due to a bit of dumb luck - there had been a fire in Juettner’s building and his plates had been tossed out a window by firefighters, where some kids found them - the forger was apprehended. The cheery 73-year-old readily admitted to his crimes:

You admit it?”

“Of course I admit it. They were only $1 bills. I never gave more than

one of them to any one person, so nobody ever lost more than $1.”

This explanation, and his personality worked in his favor in the courtroom:

The man’s age and likeability did a number on the judge: Juettner was given a dramatically reduced prison sentence of 1 year and 1 day — a duration that allowed for parole after 4 months.

And, for good measure, he was made to pay a fine of $1.

In 1950, a comedy about Juettner’s caper called Mister 880 actually won an Academy Award. Juettner made enough money off the film to live comfortably for the rest of his life. I love a scam with a happy ending.

Art Heist, Sort Of

Holland is a country with a lot of art. It’s also a country with a lot of art theft. Except! In this case, the thieves did not bother stealing the art, and simply stole payment for the art:

The Rijksmuseum Twenthe in Enschede, the Netherlands, was in the midst of a months-long email negotiation with dealer Simon C. Dickinson to purchase a prized John Constable painting when hackers hijacked the exchange, posing as Dickinson and convincing the museum to funnel the money into a Hong Kong bank account.

It gets more complicated, because the museum’s director, Arnoud Odding, had taken the painting to his museum in an attempt to raise the money to purchase it from Dickinson. He basically put the painting on reverse consignment - give it to us, and we’ll use it to solicit donations to buy it. It all seems a bit odd but I am the guy who thinks the entire art market is a scam, grain of salt, etc.

So, Odding spends all this time raising three million dollars to buy the painting he’s got on loan in his gallery. Then, just as he’s about to close the deal, someone posing as Dickinson sends him an email asking if he can send the funds to a different bank account. Odding agrees, and fires three million bucks off into the void.

Not good! But, now, the two men are suing back and forth for ownership of the painting. Dickinson says Odding’s museum should have verified the account before sending the wire transfer. The museum says Dickinson’s email was hacked, and therefore it’s his fault. The painting is still in storage at Odding’s museum, and they are refusing to give it back. Woof.

But, as this illustrated Bloomberg feature points out - this might be the perfect art heist? The thieves never had to touch the painting, which would have been difficult to fence. Instead, they waited for the right moment, inserted themselves in the deal, and made off with the cash. I understand their logic - the best way to extract money from the art market is to take advantage of the rich idiots who run it.

Quibi

I have wanted to write about Quibi for awhile now. Don’t know what Quibi is? You’re not alone. It’s a streaming service that has raised almost $2 billion dollars in investor cash and hired some big name talent. What it does not have is users. Not long after it launched, the app fell out of the top 50 on the Apple store, and it’s struggled to gain traction with its “quick bite” video format. This seems counter-intuitive, since most other major streaming services are crushing it. The CEO tried to blame the app’s failure on COVID:

Katzenberg has refused to accept responsibility for the debacle. “I attribute everything that has gone wrong to coronavirus,” Katzenberg toldThe New York Times. “Everything.”

But, again, the math doesn’t add up - Netflix, Disney, and other services are thriving. Even something called “Mormon Netflix” is doing numbers!

So what the hell happened to Quibi? It fell victim to a terminal case of Venture Capital Brain:

“People on Quibi have $100,000 a minute to make content,” Katzenberg tells me. “That doesn’t exist on other platforms.” Producers who went into meetings with him skeptical walked out thinking he might be onto something.

I am not an accountant, but that seems like a lot of money for 7 to 10 minute clips on a streaming service? And, despite recruiting some of the best directors and actors and giving them near total creative license, the platform hasn’t managed to field any hits:

The app’s ranking dropped to No. 284 by mid-June. A handful of shows, such as a reboot of Reno 911!, seem to have found an audience (it’s impossible to know precisely how large an audience, since Quibi, like other streamers, doesn’t release numbers), but critical attention has focused mostly on the flops.

As the author points out, the technology behind the app is actually pretty good. The concepts for the shows and documentaries seem good. What happened?

Katzenberg is a media executive with decades of success, but he may have climbed too far up his own ass with the “snackable” content format:

Who needed Quibi to break things up into “snackable” chunks for them to begin with? As one longtime Hollywood executive told me, “I have a pause button.”

Ouch. Then there was his concept to have Quibi as a mobile-only service, not (easily) streamable on TVs:

To combat the idea that Quibi would be providing something that already existed, Katzenberg leaned into making Quibi seem different. To emphasize that this wasn’t just TV on your phone, he declared that Quibi wouldn’t even be available on your TV when the app launched.

Finally, high quality video content I can only watch on my phone! All that high quality content, as it turned out, was mostly scripts that other studios had rejected:

In other words, Quibi is getting A-talent’s B-material, or else producers’ desk-drawer scripts, which haven’t been able to attract a more established buyer. “If we have a show that’s going to be a huge hit, you pitch to Netflix, HBO,” says a producer with a project at Quibi. “If it doesn’t get traction, you pitch to Quibi.” Indeed, many of the shows Quibi picked up had been widely shopped elsewhere beforehand.

There are some other fun…bites in the piece - Meg Whitman, CEO of Quibi, doesn’t watch TV. Katzenberg wanted to call the app Omakase because he likes expensive sushi dinners. They maaaaay have stolen their signature tech from someone else:

And Quibi has had to contend with a lawsuit over its beloved Turnstyle. Filed by Eko, a New York–based interactive-video company that had met with Quibi employees several times, including once with Katzenberg, the suit claims the Turnstyle technology was stolen from Eko.

It’s another brick in the wall of venture-backed companies lighting huge piles of cash on fire. Quibi was the brainchild of a hitmaker who decided he knew better than his customers what they wanted, and tried to ram it down their throats. A lot of Hollywood bought his schtick, but it seems the customers whose subscriptions he’s now depending on aren’t willing to do the same.

Important U-Haul Van Update

Despite crafting an amazing post about swapping an engine out of a rental van into his truck, the author has confirmed it was actually a joke. He’s not even old enough to rent from U-Haul. Bummer.

Short Cons

BBC - “A leading medical-research institution working on a cure for Covid-19 has admitted it paid hackers a $1.14m ransom after a covert negotiation witnessed by BBC News.”

Washington Post - “According to the criminal complaint, Mark Grenon founded the company as a church in 2010 “for the express purpose of cloaking their unlawful conduct” by framing all of their activities as protected religious freedoms.”

Bloomberg - “Sean Murphy was an epic weed smoker, a devoted Tom Brady fan, and the best cat burglar that Lynn, Mass., had ever seen.”

Tips, sushi tastings, or Super Bowl rings to scammerdarkly@gmail.com