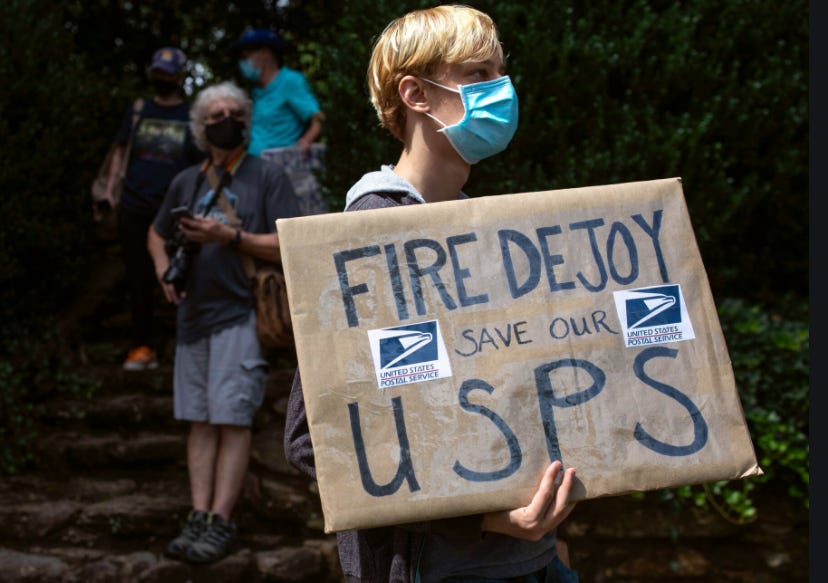

The Postal Service

The US Postal Service has been in the news lately. Though it’s consistently the most popular service the American government provides its citizens, Republicans have attempted to starve it of funds. This culminated in 2020, with the appointment of a Board of Governors filled with anti-governmental capitalists, and a Postmaster General who attempted to gut the agency the minute he took office. Never mind the fact likely got the job due to illegal campaign donations.

The ostensible reason opponents of the USPS cite to justify cost-cutting is the agency’s budget deficit. In 2006, Congress signed a bill called the Postal Accountability and Enhancement Act, or PAEA. Most discussion centers on the PAEA’s requirement that the USPS pre-fund its pension and health care plan, to the tune of $54.8 billion dollars over ten years.

By itself, this attempt to bankrupt the USPS would be bad. What’s worse is Congress passed the PAEA to avoid the money it owed to the agency. Aaron Gordon explains:

In November 2002, the Office of Personnel Management (OPM) discovered something that made "jaws drop" in the U.S. Treasury Department: the USPS had been quietly overpaying into its pension fund, which was held by the Treasury Department, for decades. Not by a little bit. But by a lot. In fact, the Treasury owed the USPS $71 billion (a subsequent USPS Inspector General investigation in 2010 found the overpayment to be $75 billion), roughly equivalent to an entire year of USPS revenue.

So…the government found out it owed $75 billion dollars to the Postal Service and, rather than figuring out a way to pay it back, flipped the script and created a report that said the USPS was facing up to $100 billion dollars’ worth of liabilities in the future.

During the Bush years in the 2000s, Republicans had racked up huge federal deficits through tax cuts and reckless spending. Now, faced with another fiscal liability, they conjured a massive Postal Service debt out of thin air to avoid having to pay the service the money it was owed:

The logical flaw at the center of this budgetary chicanery is actually quite simple. Future health care costs, be it for employees or retirees, are just that: in the future. It's not money anyone owes anyone else any time soon. It's just a guess about what will happen. To put it right next to current expenses and revenues as if these are debts the USPS has is Einsteinian in bending the fabric of space-time. It is an accounting lie.

The analogy I often see presented—including in Save The Post Office's indispensable coverage over the years of the PAEA's impact on the USPS—is that of a mortgage. Imagine you took out a mortgage for $300,000 including interest over its 30-year life, working out that's $833 per month in payments (mortgages aren't that simple but for our purposes here it's fine). That does not mean you start budgeting your monthly finances as if you now owe $300,000. "Sorry honey, we can't afford to replace your car that keeps catching on fire," you would never say to your significant other, "because we have a $300,000 mortgage."

Essentially, Congress decided that the USPS should pay a 30-year mortgage in ten years, and also that it wouldn’t reimburse any of the overpayments the USPS had already made. Genius!

Then, two years later, the Great Recession happened, and crushed USPS revenues. The $5.5 billion yearly payments put it into the red, just as conservatives had hoped they would. Incredibly, without the pension payments the Postal Service would have remained profitable between 2007-2010, while the global economy melted down.

The problem can be fixed - Louis DeJoy almost certainly broke the law and should be removed from his post. Congress can repeal or modify the PAEA and give the USPS the funds it needs to continue to be a successful, popular governmental agency. As the pandemic has made clear, mail delivery is a critical service for most Americans. Whether a Biden administration can fix what’s wrong remains to be seen, but it’s important to remember that the problems at the Postal Service were created whole cloth by legislators looking for a cover story to hide their malfeasance.

Debt Collectors

The Consumer Financial Protection Bureau (CFPB) was the brainchild of Elizabeth Warren, before she became a Senator. For a time, the bureau focused on protecting Americans from predatory financial products and services.

Then Trump happened. First, he appointed Mick Mulvaney to run it. Mulvaney was a hard line Republican who hated regulation and the concept of consumer protection:

It wasn’t up to the federal government to stop people from taking the kind of credit that suited them, he suggested: “There’s no reason people should be taking these loans — but they do.”

After Mulvaney gutted the CFPB, Trump installed a new toadie to run it. In late October, the agency released a new rule allowing debt collectors to be far more aggressive:

Once the new rule takes effect a year from today, collection agencies will also be allowed to contact consumers more frequently. They’ll be able to place up to seven debt-collection phone calls per week (and under some circumstances even more), as well as send an unlimited number of text and email messages and social media private posts.

The CFPB noted in its announcement today that consumers can opt out of all electronic communications with debt collectors. How exactly they'll be able to do that, though, hasn't been worked out yet.

Ah, good. There’s certainly no way that could go wrong. Especially not in a country where nearly a quarter of the population is in collections:

The CFPB's new rule could have broad implications for the nearly 1 in 4 adult Americans—about 70 million people—who have a bill in collections at any given time, according to the National Consumer Law Center. And it could have a significant impact on the estimated 18 million who have more than one bill in collections—meaning a consumer could receive multiple contacts a day from multiple collectors.

America decided long ago that it would punish the poor rather than helping them out of poverty. Expansive government bureaucracies ensure that the poor get exactly the benefits they are entitled to, and not a penny more. The IRS has made auditing poor families a prime directive.

The CFPB announcing this new rule for debt collectors as the country faces record unemployment and economic catastrophe is a particularly cruel touch. Fortunately, thanks to a Supreme Court ruling in a case brought by conservatives trying to abolish the agency, the next president can fire the head of the CFPB and replace her with someone who can refocus the agency on protecting consumers.

Grading Software

The coronavirus pandemic has forced millions of children in the US to take classes remotely. Many school districts, given very little time to prepare, turned to distance learning platforms like Canvas to administer and help grade tests and quizzes. For all we hear about how machines are going to replace us, it turns out they’re not very bright either:

Auto-grading promised to save teachers time but now has many of them spending hours poring over answers to their students’ every assessment and exam—if they’re aware of the grading problems at all.

The root of the failure is in the simplistic design of many grading bots: They try to match a student’s response to a teacher’s answer key. If the two aren’t identical, the response is often marked wrong, even if a human could easily see it’s correct. It is yet another headache for teachers, parents and students brought on by the sudden shift to remote learning.

The makers of such educational software acknowledge the problems with auto-grading and say many teachers didn’t have enough time to properly train on how to use the online platforms.

I understand the appeal of an “auto-grading” feature when you’re a teacher setting up remote learning and attempting to cope with unexpected pandemic restrictions. But shouldn’t these software companies be training teachers on these systems? Or schools? Or someone?

I cannot fathom how difficult it must be to teach via video conference - it’s hard enough in a physical classroom. But, like may technological “solves” attempts to software-ize classrooms has led to more work for teachers, and could penalize students with poor grades.

Who makes Canvas? A company called Instructure, which was bought in 2019 by a private equity firm for $2 billion in cash. Instructure is merely a platform - they aren’t responsible for incorrect grades, or the potential impact their software could have on the quality of education students receive. Our country’s underfunded education system and increased dependence on outsourced tech solutions means underpaid, overworked teachers have to double as tech support. If you happen to be born poor, you’ll receive an even worse education than if you lived anywhere else in the developed world.

Apple

Since August, Apple has been feuding with software developers over the fees it charges to be listed in its App Store. Apple took a 30% cut of any digital revenue generated by apps, which many independent developers felt was onerous. Some larger developers have sued Apple, who has argued that their fees are industry standard.

Now, Apple has reversed course. Sort of:

Apple, facing growing antitrust scrutiny over what it charges other companies for access to its App Store, said on Wednesday that it would cut in half the fee it took from the smallest app developers.

Developers that brought in $1 million or less from their apps in the previous year will pay a 15 percent commission on those app sales starting next year, down from 30 percent, the company said.

I guess they didn’t need to charge that 30% after all! It turns out, nearly every app developer falls under the threshold:

The change will affect roughly 98 percent of the companies that pay Apple a commission, according to estimates from Sensor Tower, an app analytics firm. But those developers accounted for less than 5 percent of App Store revenues last year, Sensor Tower said.

So 98% of apps in the store generate less than $1 million in yearly sales, which makes sense. More maddeningly, Apple was leaning on developers for a vanishingly small amount of money compared to the profits it made elsewhere. Apple PR is doing their best to spin this as an altruistic campaign to help struggling small companies through the pandemic, but it’s also barely noticeable on their balance sheet.

Whether this strengthens their defense against the lawsuits remains to be seen, but it’s a good reminder that many of the big tech firms make a lot of their money off the hard work of others, while they sit as gatekeepers to their devices and platforms.

In an unrelated aside, Apple gets around a fifth of its income from Google, who pays them billions of dollars a year to be the default search engine on their devices.

Nikola

Nikola stock rose 15 percent on Wednesday after confused investors apparently mistook a month-old GM website for a brand-new announcement about the companies' pending agreement. The stock is up another 7 percent as I write this on Thursday morning.

[…]

On Reddit, commenters pointed out that the page said "the transaction has not yet closed." But people shrugged that off, arguing that GM wouldn't have posted about the deal if closing wasn't imminent. One commenter took the stock price jump as further confirmation of the news.

But they were mistaken. It wasn't a new GM announcement. The page has been on GM's website since at least October 5. An archive of the page from that date includes exactly the same language about Nikola—albeit without the disclaimer about the deal not being closed yet.

Despite the company being a giant fraud and the founder resigning amidst sexual assault allegations, it appears the people buying and selling its stock aren’t bothered. Efficient markets!

Short Cons

BBC - “As of 1996, about half of the countries in the OCED allowed companies to deduct bribes paid to foreign officials from their taxes, including Germany, France, Australia, New Zealand and Switzerland. They argued that such practices were routine business expenses in some countries.”

WSJ - “In addition to the “pull” of repeatedly seeing viewpoints that reinforce our own, inside of our online echo chambers, repulsion provides a “push” away from opposing viewpoints…”

Wired - “Still, though. Before you start giving a drug to the thousands, soon to be millions, of people affected by a pandemic virus, you want to be very, very sure it's safe and effective, that the benefits of administering it outweigh the risks and side effects.”

Cincinnati Enquirer - “In another conversation quoted in the indictment, also in November 2018, Sittenfeld said: "I can deliver the votes."”

Bloomberg - “Coca-Cola Co. will remain on the hook for the bulk of a $3.4 billion IRS tax bill linked to multinational operations to produce the company’s famous beverages.”

Tips, thoughts, or pension funding requirements to scammerdarkly@gmail.com